A Business Registration Certificate (BRC) is an official document issued by a government authority that confirms a business's legal existence and compliance with local regulations.

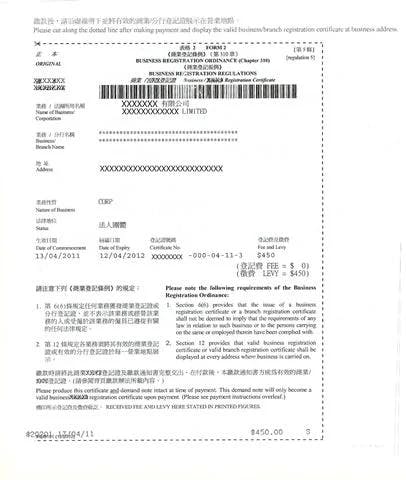

Business Registration Certificate contains details such as business registration number, company name, business name, address, nature of business, incorporation date, and expiry date of the certificate.

A Business Registration Certificate is required for all local and non-Hong Kong companies operating in Hong Kong. It includes representative offices of overseas companies, companies letting out property in Hong Kong, and various trades and professions.

Sole proprietorships must apply separately using the ‘Request for Business Registration Application Form' (IRBR194). Different forms are required based on business structure, and a separate certificate is needed for each branch.

Additional licenses and permits may be required based on business nature and operations (e.g., food importation license, SFC license, money service operator license).

When you set up your company in Hong Kong, you must incorporate according to the Companies Ordinance guidelines and have a valid Business Registration Certificate issued by the Inland Revenue Department.

This document is absolutely crucial to your company.

This article outlines everything you need to know about the Business Registration Certificate in Hong Kong: what it is, how you can get one, and why you need one, including any other additional guidelines around it.

1. What Is a Business Registration Certificate?

A BR Business Registration Certificate is an official document issued by the Business Registration Office of the Inland Revenue Department upon registration.

A BR Certificate contains all the details of a company, including its:

- Business registration number

- Company name

- Business name (if different from company name)

- Address

- Nature of business

- Date of company incorporation

- Expiry date of the BR Certificate

If you change any details of your business, you must report to the Business Registration Office within 30 days.

The registration number on the BR Certificate is also known as the tax identification number (TIN) of your company.

2. Which Businesses Need a Business Registration Certificate?

The Inland Revenue Department states that the following types of businesses and activities are required to be registered with the Business Registration Office:

- A local and non-Hong Kong company that has established a business in Hong Kong, regardless of whether there is any business activity carried out or not

- Overseas companies that have a representative or liaison office in Hong Kong

- Overseas companies that have let out their property based in Hong Kong, regardless of whether it has an established place of business in Hong Kong

- All types of trade, craftsmanship, commerce, profession, or activity carried out for gain

- Any club that provides services, facilities, and exclusive club premises to members for social interaction and recreational purposes

To keep it simple, all companies, sole proprietorships, or partnerships in Hong Kong need to register and pay a business registration fee to get a Business Registration Certificate.

Exceptions exist. For example, charitable institutions do not need a Business Registration Certificate.

There also is an exemption for individual shoe polishers.

3. How Can You Obtain a Business Registration Certificate?

When you register a company in Hong Kong, you will automatically obtain a BR Certificate as soon as it is incorporated.

Even if it is issued by the Inland Revenue Department, the Business Registration Certificate will be collected from the Hong Kong Companies Registry together with the Certificate of Incorporation.

If you register a sole proprietorship, you have to apply to the Business Registration Office to get your BR Certificate.

The application process involves completing the ‘Request for Business Registration Application Form' (IRBR194) form and paying the required fee.

There are different forms depending on the structure of your business. All you have to do is select the option that applies to you and fill in the corresponding form.

Also, if you have a business at another branch, you will need to obtain a BR Certificate for that branch.

4. Do You Have to Register Your Business Name?

You have to register a business name as part of the registration process.

It is advised by the Inland Revenue Department to either register a Chinese name only, an English name only, or register both a Chinese name and English name.

Please note that your business name does not have to be the same as your company name.

5. What Is Business Registration Number?

A Business Registration Number is a unique number used to identify and register a business with the Inland Revenue Department.

The unique eight-digit number is mentioned on the BRC.

It needs to be provided when conducting business activity that is regulated by government bodies.

People often get confused between the Business Registration Number that is displayed on the BRC with the Company Registration Number displayed on a Company Registration Number.

To understand the difference between both certificates in detail, please refer to our previous article on this topic.

6. Should You Display a Business Registration Certificate for Inspection?

Businesses operating in Hong Kong are required by law to display the original BR Certificate at the place of business, including its branches, so the relevant officer or representative from regulatory and governmental bodies can see and verify it during an inspection.

Not only should you do this to comply with regulations but also because it can be beneficial for your business.

Seeing an original Business Registration Certificate gives an excellent impression to existing and potential customers.

7. What Happens If You Fail to Comply?

Non-compliance can result in heavy fines if you fail to register on time or register too late.

If you register too late, you will have to pay a fee for all the years that you have not complied with, including any additional penalty that is imposed.

Non-compliance can cause significant disruptions to your business as you may face difficulty in filing tax returns.

8. Are There Other Licenses and Permits Needed?

It is important to note that along with a BR Certificate, you may need other licenses and permits to run your business.

These licenses and permits will depend on the nature of your business and business operations (e.g. food importation license, SFC license, money service operator license, and additional licenses, etc.).

Final Words

Here is what you should always have in mind:

- A Business Registration Certificate is required for your Hong Kong company

- The Registration Number on the BR Certificate is also known as your company's Tax Identification Number or TIN

- The Registration Number on the BR Certificate is different from the Company Number mentioned on your company's Certificate of Incorporation

- You must ensure that your Business Registration Certificate is renewed on time upon expiry

- When using Air Corporate's business registration service, you can access and download your Business Registration Certificate 24/7 from our secured cloud platform.

Looking to incorporate your business in Hong Kong?

Register today with Air-Corporate, and get access to all your required documents online, anytime.

Focus on your business. We take care of the rest.