The Business Registration Number (BRN) is a unique eight-digit number assigned to each business by the Inland Revenue Department (IRD) and is found on the BRC.

The BRN is used for all official business activities but does not permit trade or business operations by itself.

All businesses operating in Hong Kong, including local and non-Hong Kong businesses, subsidiaries of foreign companies, partnerships, sole proprietorships, branches, and representative offices, must obtain a BRC. Certain entities like employees or non-operational businesses are exempt.

Businesses must apply for a BRC within one month of commencing operations. Special cases include limited partnership funds and companies incorporated under the Companies Ordinance, which have specific registration timelines.

A business registration certificate HK is critical for anyone who wants to do business in Hong Kong, especially local companies.

It serves as proof that your business complies with the regulations set out by the Business Registration Ordinance (Cap. 310) and is authorized to operate in the region.

However, navigating the registration process can be challenging. If you don't follow the procedure to the T, your plans can be delayed, and your business may not take off.

So here's the ultimate roadmap — a guide that tells you everything you need to know about obtaining a business registration certificate. You will learn about:

- The need for a valid business registration certificate

- How is it different from a business registration number

- Which businesses need to obtain the certificate and what's the process

- When do you need to start the application process

What Is a Business Registration Certificate (BRC)?

A business registration certificate is a document issued by the Business Registration Office of the Inland Revenue Department (IRD), Hong Kong. It certifies that a business is registered with the Hong Kong government.

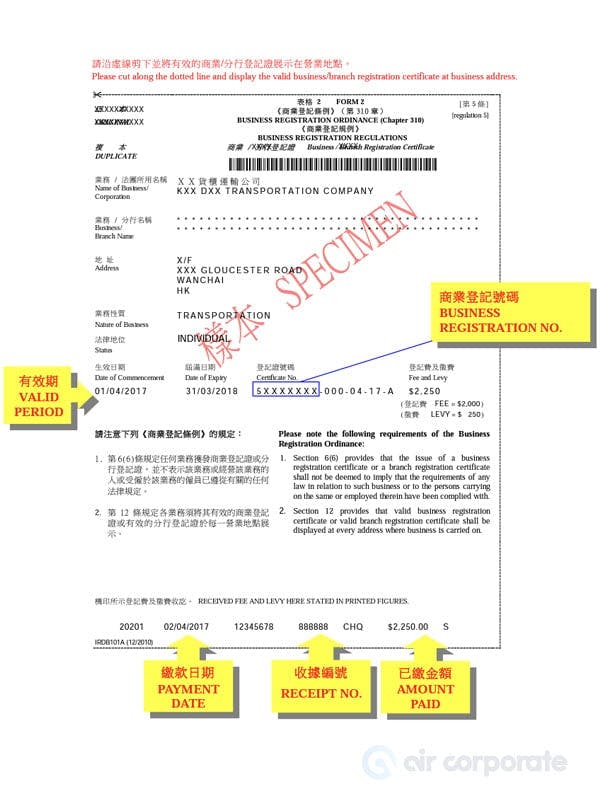

The issuance of BRC proves that your business has complied with the relevant requirements to operate in Hong Kong. Important information you may find on your BRC include:

- Registered name of your business

- The nature of your business

- Business registration number or BRN

- Issue and expiry date of the certificate

Here's a sample BRC:

Source: Inland Revenue Department of Hong Kong (IRD)

Once you receive your BRC, display it prominently in your place of business. Failure to apply for business registration attracts strict penalties — as of date, the fine is HKD 5,000, and you may also be imprisoned for one year.

If you apply for your business registration certificate one year after commencing the operations, you have to pay the registration fees for the current year and the previous years.

Is There a Difference Between BRC and BRN?

BRN or business registration number is an eight digit unique number assigned to every business entity by the IRD. You can find it printed at the bottom of your BRC.

However, it is not a permit for commencing trade or business operations.

You can think of it as the social security number for your business — you need to mention it for all official business, such as filing tax returns, opening company accounts, or filling out different forms/documents issued by government departments.

That's why you don't need to apply for a separate tax identification number in Hong Kong — the BRN is good enough.

Which Businesses Are Required to Get a Business Registration Certificate?

Obtaining a business registration in Hong Kong is mandatory for all businesses unless specifically exempted by the Hong Kong Companies Ordinance.

Both local and non-Hong Kong businesses need to apply for BRC, including:

- Subsidiaries of foreign companies in Hong Kong, even though the company may have subsidiaries operating in other countries;

- Partnerships and sole proprietorships

- Branches and representative offices of foreign companies

- Any other business venture operated to earn profits, whether by opening up a brick-and-mortar shop or through the internet

- A club that provides various facilities or services to its members for a fee

- Any limited partnership fund registered under the Limited Partnership Fund Ordinance, irrespective of whether it is carrying on business operations in Hong Kong

However, if you are only an employee of one of these organizations, you're not considered to be "carrying on a business" for registration purposes. In that case, you do not need to apply for a BRC.

When Should Your Business Apply for a BRC?

Here's a breakdown of when your business should apply for a Business Registration Certificate (BRC) in Hong Kong:

| Business Type / Case | When to Apply for Business Registration Certificate (BRC) |

|---|---|

| Sole Proprietorship | Within 1 month of commencing business |

| Partnership (except Limited Partnership Fund) | Within 1 month of commencing business |

| Unincorporated Body of Persons | Within 1 month of commencing business |

| Non-Hong Kong Company | Within 1 month of commencing business |

| Branch of a Non-Hong Kong Company | Within 1 month of commencing business |

| Limited Partnership Fund (Special Case) | Within 1 month from the date of registration |

| Company Incorporation (Special Case) | Through IRD’s one-stop service when incorporating with the Companies Registry |

What are the Types of Business Registration Certificates in Hong Kong?

Businesses in Hong Kong can apply for two types of Business Registration Certificates (BRC):

- Standard Business Registration Certificate – Required for all businesses operating in Hong Kong.

- Branch Business Registration Certificate – Needed for each additional branch or office of a business.

Both types of certificates are available for one-year or three-year validity periods. Under Hong Kong law, businesses must display a valid BRC at every location they operate.

The Hong Kong government has revised the application fees for BRCs, but the HK$150 annual levy for the Protection of Wages on Insolvency Fund is waived until 2026.

Updated Fees for BRC

Standard Business Registration Certificate

- One-Year Certificate: HK$2,200

- Three-Year Certificate: HK$5,720

Branch Business Registration Certificate

- One-Year Certificate: HK$80

- Three-Year Certificate: HK$208

Example of Business Registration Costs in 2025

Applying for a one-year standard BRC in 2025 costs HK$2,200.

A three-year standard BRC costs HK$5,720, with the waived levy reducing the total to HK$5,720 instead of HK$5,870.

Special Case: Late Registration for Pre-2024 Businesses

If your business started before April 1, 2024, but you apply for a BRC in 2025, fees are based on your business start date, not the application date. This means:

- One-year certificate: HK$2,150 (includes levy).

- Three-year certificate: HK$5,650 (includes levy).

How Do I Apply for a BRC?

There are several application channels for obtaining your business registration certificate:

By Post

You can apply for a BRC by mailing your application to the Business Registration Office. To obtain a copy of the application, you can e-mail taxbro@ird.gov.hk.

Fill up form IRBR194 or send in your request by post (P.O. Box 29015, Concorde Road Post Office, Kowloon, Hong Kong) or by fax (2824 1482) to the Business Registration Office.

Be sure to include your name, address, the type of form you're requesting, and how many copies you need.

The certificate is issued within 2 working days of the Business Registration Office receiving a properly completed application.

In Person

You can submit a physical copy of your application for one-stop service in person at 4/F Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong. Online applications will result in electronic certificates only.

Another way is through direct application with IRD., You can submit a physical copy of your application in person at the Business Registration Office (2/F, Inland Revenue Centre, 5 Concorde Road, Kai Tak, Kowloon, Hong Kong)

Typically, the business registration certificate is issued within 30 minutes to 1 hour of the receipt of the application. You can collect it over the counter.

Online

You can use the eTax service by the Government of Hong Kong and apply for your business registration certificate online. The online service is available to:

- A sole proprietor

- Partners of a partnership

- The secretary, manager, or any of the directors of a company

- Principal officers of a branch of a business

Online applications will result in electronic certificates only. Normally, the certificate is issued within 2 working days from the receipt of a duly filled application.

Before you begin, you can check out a specimen application form for business registration for body corporates.

Regardless of the application method, you must pay the relevant business registration fee and levy and attach a copy of your proof of identity document with your completed application. Accepted documents include:

- For individuals – a copy of their Hong Kong identity card (for residents) or passport (for non-residents)

- For body corporates – a copy of the Certificate of Incorporation or its equivalent issued by the relevant authority of the original jurisdiction of incorporation.

- Partnerships (except limited partnership fund) – copies of every partner's Hong Kong identity cards or passports for non-residents

- Limited partnership fund – a copy of the Certificate of Registration issued by the Companies Registry and a copy of the general partner's Hong Kong identity card if the partner is a resident. For non-residents, a copy of a passport or identity card, or a certificate of incorporation or registration if the general partner is a limited partnership or a company

- Unincorporated body of persons – for residents, a copy of the principal officer's Hong Kong identity card. For non-residents, a copy of passport/identity card.

If you need to update your business registration details, you can do it online or by sending a written notice through the mail. There's no need to make an appointment or visit the Business Registration Office in person.

What Happens if You Register Your BRC Late in Hong Kong?

If you don’t register for a Business Registration Certificate (BRC) on time, you might face some serious problems.

If you don’t register within 30 days, you could be fined HKD 5,000 and even spend up to a year in jail. Not following the rules can cause legal problems that make it harder to run your business.

Without a BRC, you might have trouble with paperwork and other important business tasks.

To avoid these issues, working with a local expert like Air Corporate can help you get registered quickly and without problems.

Why Use a Service Provider for Your BRC Application?

Applying for a Business Registration Certificate (BRC) in Hong Kong might seem easy, but it can take a lot of time and effort. A company like Air Corporate can make the process smoother and faster. Here’s how they help:

- Expert Help: Air Corporate knows all the rules and requirements, making sure your application is correct and complete.

- Saves Time: They handle the paperwork so you can focus on running your business.

- Prevent Mistakes: Their experts help avoid common errors that could slow down or reject your application.

- Thorough Assistance: Air Corporate can also help with company registration, taxes, and legal requirements, making it easier to manage your business.

Using a trusted service provider like Air Corporate can make the BRC application process quick and stress-free.

Need help with company registration? We can set up your Hong Kong company with a bank account in just two days.

FAQs

A business registration certificate in Hong Kong is proof that the business is duly registered with the Hong Kong government and has fulfilled the requirements for operation.

A certificate of incorporation is the birth certificate of your company — it confirms that your company has come into existence as a standalone legal entity.

Once you successfully pay the business registration fee/levy online, you receive an acknowledgment with a Transaction Reference Number. This indicates that your submission was successful.

While you can do the paperwork on your own, it is best to outsource to an external agency such as Air Corporate.

This ensures you receive your registration certificate without breaking a sweat.

This is only possible if you have applied online.

You can write to the Commissioner of Inland Revenue with the details of the changes you need. Make sure to include your name, capacity, name of your business, and the Transaction Reference Number of the application.

The time it takes to get a Business Registration Certificate (BRC) depends on how you apply. If you apply online through the One-Stop Service, you may receive it within an hour. However, applying in person or by mail usually takes a few working days.

Yes, Hong Kong Business Registration Certificates are valid for either one year or three years. To keep your business legally registered, you must renew your certificate before it expires. You can do this online or at the Business Registration Office. The renewal process is similar to applying for the certificate the first time.