Both numbers are needed for business operations and legal documentation.

Failure to register for a BRN can result in fines up to HKD 5,000 and/or a year in prison. Both numbers are mandatory for legal business operations.

The BRN will now also be called the Unique Business Identifier (UBI). The UBI replaces the CRN and serves as the Tax Identification Number (TIN).

Air Corporate offers a 10% discount for registration services, providing a hassle-free process to obtain CRN and BRN.

Before you start a business in Hong Kong, make sure you understand the regulations, apply for all of the appropriate paperwork, and know what is needed to make your business a success.

Your initial step is to register with the Companies Registry to gain limited company status. Next, to be accepted as a Hong Kong business, you must register with the Business Registration Office.

When moving through the process, you'll find that two numbers are imperative when filling out all legal documentation. Whether you're renting office space, opening a bank account, or signing contracts, you will need to provide both the company registration number and the business registration number.

Hong Kong Company Numbers: CRN and BRN

In Hong Kong, there is a strict line that separates a “business” from a “company.” Therefore, the company registration number (CRN) differs from the business registration number (BRN).

Hong Kong Company Registration Number (CRN)

Company registration means officially setting up a company with the Companies Registry under Hong Kong’s Companies Ordinance. CRN is a seven-digit number, and this number is, in essence, your company's social security number. It helps identify the company in official records and makes sure each company has a unique ID to avoid confusion.

Documents Needed to Get a CRN in Hong Kong

| Requirement | Local Company | Non-Hong Kong Company |

|---|---|---|

| Application Form | Form NNC1 (limited by shares) or Form NNC1G (not limited) | Form NN1 |

| Articles of Association | Required | Included in certified constitutional documents |

| Certified Constitution | N/A | Certified copy of charter/statutes/memorandum and articles |

| Certificate of Incorporation (foreign) | N/A | Certified copy required |

| Latest Published Accounts | Not required | Certified copy required |

| Notice to Business Registration Office | IRBR1 | IRBR2 |

| Certificates Issued Upon Approval | Certificate of Incorporation + Business Registration Certificate | Certificate of Registration + Business Registration Certificate |

Submit these documents with the required fees either electronically via the e-Services Portal or in hard copy to the Companies Registry. After processing, you'll receive the Certificate of Registration of Non-Hong Kong Company and the Business Registration Certificate.

It's important to ensure that all documents are accurately completed and submitted promptly to facilitate a smooth registration process.

Sole proprietorships and general partnerships are not required to have a CRN.

Hong Kong Business Registration Number (BRN)

BRN is the number used for tax purposes rather than identification purposes. It is required on all tax forms, like filing annual returns and day-to-day business operations.

Hong Kong businesses can apply for a BRN online and in-person application is also allowed. You may apply online at the Inland Revenue Department's website or download a form and submit it in person.

Documents Needed to Get a BRN in Hong Kong

| Category | Local Companies | Non-Hong Kong Companies |

|---|---|---|

| Required Documents |

Incorporation Form (NNC1 or NNC1G) Notice to Business Registration Office (IRBR1) Articles of Association (if applicable) |

Form NN1 with relevant incorporation documents Notice to Business Registration Office (IRBR2) |

| Fees |

One-Year Certificate: HK$2,200 Three-Year Certificate: HK$5,870 |

One-Year Certificate: HK$2,200 Three-Year Certificate: HK$5,870 |

After the application form and additional documents are submitted, they are evaluated. The Companies Registry will then email you a notification upon the issuance of your business registration number.

If your company is accepted, you will receive a Business Registration Certificate.

The Hong Kong BRN acts as your tax identification number (TIN). The Hong Kong Inland Revenue Department must issue it before a business is allowed to open a base of operation in Hong Kong.

The format looks like this: 11111111-&&&-&&&-&&-&. The BRN is the number represented by the ones.

Companies incorporated in Hong Kong (under the Hong Kong Companies Ordinance) are automatically considered active businesses and must get a BRN under the Business Registration Ordinance (Cap. 310).

What's the Difference Between CRN and BRN?

| Feature | Business Registration Number (BRN) | Company Registration Number (CRN) |

|---|---|---|

| Issued By | Inland Revenue Department (IRD) | Companies Registry |

| Format | 8-digit number | 7-digit number |

| Location on Certificate | Middle of the Business Registration Certificate | Top-left corner of the Certificate of Incorporation |

| Purpose | Acts as a tax ID number for businesses | Acts as a company ID number |

| Who Needs It? | All businesses except non-trading offices, approved charities, and farms | Only LLCs and foreign companies |

| Sole Proprietors & Partnerships | Need only a BRN | Do not need a CRN |

| Expiration | Expires and must be renewed every 1 or 3 years | Does not expire, remains valid while active |

Where to Find a CRN or BRN?

Upon incorporation, any Hong Kong company will receive 2 essential documents:

- Certificate of Incorporation: This document includes the Company Registration Number of your company.

- Business Registration Certificate: This includes your company's Business Registration Number.

You can search for your company's CR number on the website of the Hong Kong Companies Registry.

Your company's BR number can be found in the Business Registration Number Enquiry section of the Inland Revenue Department's website.

Please see below for a sample of a Hong Kong company Certificate of Incorporation with the company's CR Number:

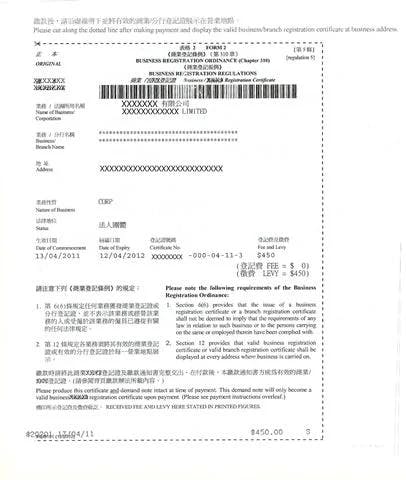

See below for a sample of a Hong Kong Business Registration Certificate with the company's BR Number:

Are There Any Exceptions for CRN or BRN Requirements?

There are no exceptions for obtaining a company registration number if you are doing business in Hong Kong.

There are a couple of exceptions for obtaining business registration numbers, including the following:

| Exception | Details |

|---|---|

| Charity Work | The charity must be government-approved, requiring proper paperwork. |

| Breeding & Rearing Livestock, Fishing, Agriculture, Garden Marketing, etc. | Exempt if these activities do not fall under a company heading or an overseas company requiring registration. Verification is recommended. |

The exemptions to the BRN are contingent upon other factors, so it is always best practice to check with local authorities, even if you think your business might fall under the exemption heading.

Key Takeaways on CRN and BRN

Hong Kong is a great place to start a business, but compliance is crucial.

- CRN (Company Registration Number) is your business ID.

- BRN (Business Registration Number) is your tax ID.

Failing to register for a Business Registration Certificate can result in a HKD 5,000 fine and up to a year in prison.

Ensure you file all necessary paperwork and follow local regulations to avoid penalties.

A Quick Look at Unique Business Identifier (UBI) for Hong Kong Companies

The Unique Business Identifier (UBI) is an essential identification number assigned to companies in Hong Kong. This identifier streamlines business operations by providing a standardized method for recognizing and interacting with companies.

The UBI simplifies various administrative processes, including registration, taxation, and compliance, ensuring that each business can be easily and accurately identified in official records.

For Hong Kong companies, having a UBI enhances transparency and efficiency. It allows for seamless communication between businesses and government agencies, reducing the likelihood of errors and discrepancies.

Is the UBI the Same as the CRN?

Yes! In Hong Kong, the Unique Business Identifier (UBI) has taken the place of the Company Registration Number (CRN) for businesses registered with the Companies Registry. The UBI comes from the Business Registration Number (BRN), which is given by the Business Registration Office. So, instead of using the old CRN, businesses now use the UBI, which includes the BRN.

Where Will the UBI Be Used?

- The UBI (which is the same as the BRN) will be used when talking to government offices and businesses.

- Companies will use the UBI when filling out forms and sending documents to the Companies Registry.

- People can use the UBI to search for companies through the Electronic Search Services of the Companies Registry.

- For businesses set up or registered on or after December 27, 2023, the UBI will appear as the company number on official certificates, like the Certificate of Incorporation or the Certificate of Registration of Non-Hong Kong Company.

Ready to open a business in Hong Kong? Register your company with Air Corporate today for an effortless company registration process, and get approved in under 48 hours.