If you are conducting business in Hong Kong, you are required to obtain a business registration. This registration certificate makes your business official in the region.

It enhances your credibility and instills confidence in your customers that you are operating in compliance with the law.

1. Who Needs to Obtain Business Registration?

Under the Business Registration Ordinance, you must obtain a Business Registration Certificate if you are:

- Carrying on any trade, profession, or activity for gain (including online businesses and freelancers).

- A club providing facilities or services to members.

- A Hong Kong-incorporated company or a non-Hong Kong company with a place of business in Hong Kong (including a representative or liaison office).

- A non-Hong Kong company that has let out property in Hong Kong.

- A re-domiciled company, open-ended fund company, or limited partnership fund.

You are not regarded as carrying on a business if you are an individual only holding an office or employment.

Common Exemptions (Subject to Conditions):

- Approved charitable institutions.

- Agriculture, market gardening, or fishing (note: this exemption does not apply where registration under the Companies Ordinance is required).

- Bootblack businesses.

- Licensed hawkers, except when operating inside a building.

2. What Is the Time Frame for Obtaining a Registration?

Sole proprietors, partnerships, unincorporated bodies, non-Hong Kong companies, and branches must apply for business registration within 1 month of starting business.

Companies incorporated in Hong Kong or registered under the Companies Ordinance (Cap. 622) use the one-stop company and business registration service via the Companies Registry (CR).

After the company actually starts business, you must notify the IRD of the business name, nature, address, and date of commencement within 1 month.

3. How Can I Apply for a Business Registration?

Companies (incorporated under the Companies Ordinance):

- Apply online via the CR e-Registry using the one-stop incorporation + business registration service.

- Your incorporation application also counts as a business registration application.

- You can use CR e-services such as e-reminders and e-monitor to track filings.

Other business types (sole proprietors, partnerships, unincorporated bodies, branches, non-Hong Kong companies):

- Submit the relevant Form 1 series to the IRD and pay the fees online or in person.

4. What Is the Registration Fee and Validity Period?

A Business Registration Certificate (BRC) can be issued for 1 year or 3 years.

1-year certificate: HKD 2,200

1-year certificate: HKD 2,200. The levy is waived from 1 April 2024 to 31 March 2026, so the total payable during this period is HKD 2,200.

3-year certificate: HKD 5,720

Base fee HKD 5,720. The HKD 150 levy per year is waived only during the period 1 April 2024 to 31 March 2026, so the total depends on the certificate start date:

- If the certificate starts between 1 April 2024 and 31 March 2025, the total is HKD 5,870.

- If the certificate starts between 1 April 2025 and 31 March 2026, the total is HKD 6,020.

Your exact total payable depends on the certificate start date and whether you choose a 1-year or 3-year certificate. The levy resumes on 1 April 2026.

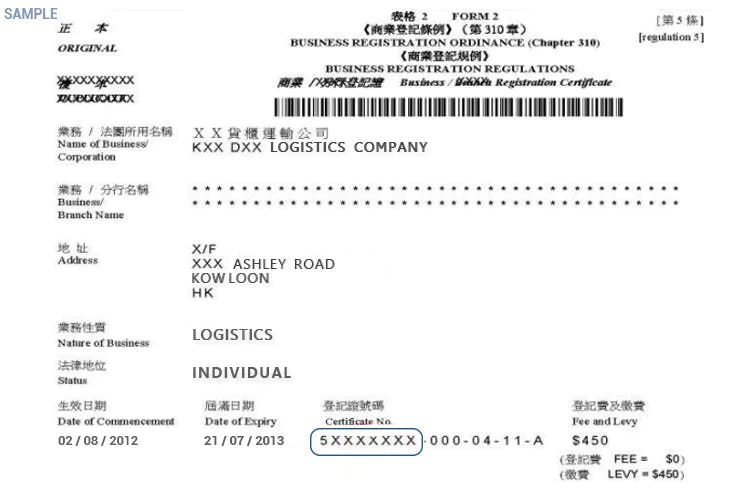

5. What Is a Business Registration Number?

The Business Registration Number (BRN) became Hong Kong’s Unique Business Identifier (UBI) on 27 December 2023, and it also serves as the Tax Identification Number (TIN) for businesses.

For companies incorporated or registered on or after 27 December 2023, the BRN/UBI is shown as the “No.” on the Certificate of Incorporation (or on the Certificate of Registration of Non-Hong Kong Company).

You should quote your BRN/UBI when dealing with the Inland Revenue Department (IRD) and other government authorities.

Many people confuse the BRN with the Company Registration Number (CRN), which the Companies Registry issues upon incorporation.

Here is a sample of BRN:

To understand the difference between the certificates in detail, please refer to our previous article on this topic.

With effect from 27 December 2023, a company’s Business Registration Number (BRN) has become its Unique Business Identifier (UBI) and is shown on both the Business Registration Certificate and, for entities incorporated/registered on or after that date, as the “No.” on the Certificate of Incorporation or Certificate of Registration of Non-Hong Kong Company.

The BRN/UBI also functions as the company’s Tax Identification Number (TIN) for IRD purposes.

6. What Happens If You Don't Apply for Business Registration On Time?

Failure to register is an offence and may result in a HKD 5,000 fine and up to 1 year’s imprisonment.

If you apply more than 12 months after commencing business, you must pay the current year fee/levy as well as any back-year amounts.

7. Should the Business Registration Use the Same Name As the Companies Registry?

A company may carry on business under an additional business name that is different from its Companies Registry name, as long as that name is properly registered for business registration.

Each branch location must have its own Branch Business Registration Certificate (Branch BRC).

If a different name is used for a branch, that name will appear on the Branch BRC.

8. Where Do I Need to Display the Business Registration Certificate?

You must display the Business Registration Certificate (BRC) at the address where the business is carried on (for each place of business / branch).

If you were issued a paper certificate, you can display that original.

However, if you were issued the certificate in electronic form, it is acceptable to display a printed copy of the e-certificate.

9. How Can I Renew My Business Registration Certification?

- The Business Registration Office sends a renewal demand note about 1 month before renewal.

- Once you pay, the receipted demand note becomes a valid BRC.

- If you do not receive the demand note, notify the Commissioner of the IRD within 1 month of the certificate’s expiry.

Renew In Person

Bring your previous BRC to the Business Registration Office, request a demand note, and pay.

Renew by Post

Mail a photocopy of your current BRC with a crossed cheque payable to “The Government of the Hong Kong Special Administrative Region.”

You’ll receive the renewed BRC at your business address.

10. What Is the Procedure for Renewing the Business Registration Certificate In Person?

Visit the Business Registration Office with your existing Business Registration Certificate and request (or present) a demand note, then pay the renewal fee at the counter

If you also need to update your particulars, you can do so at the same time:

- Use Form IRC3111A to notify a change of business address.

- Use Form IRBR193 to notify a change in business nature.

- Use Form IRC3113 if the business has ceased (file within 1 month of cessation).

11. Apart from Registration, Do I Need Other Licences or Permits?

Business registration is not a business licence. Depending on your activities, you may also need specific licences or registrations (for example, food and beverage premises, schools/education, money service operator (MSO) licence, or various Securities and Futures Commission (SFC) licences).

Always check the latest official guidance for your sector and confirm your licence position before you start trading.

12. Is There a Way to Access Information About Registered Companies?

You can use the Companies Registry e-Services to search company particulars and filed documents via the Integrated Companies Registry Information System (ICRIS) and the Company Search Mobile Service, including tools that map CR numbers to BRN/UBI under the UBI regime.

13. What Happens to the Registration Certificate If My Business Ceases Operations?

If your business ceases, you must notify the IRD within 1 month using Form IRC 3113 (Notification of Cessation of Business) so they can cancel the Business Registration and stop charging future fees.

14. What Are the Requirements for Company Deregistration?

You must first apply to the IRD for a “Notice of No Objection to a Company being Deregistered” using Form IR1263, with the prescribed fee.

Once the Notice of No Objection is issued, you must file Form NDR1 (Application for Deregistration of Private Company) with the Companies Registry within 3 months of the date of that notice, together with the HKD 420 application fee.

Final Words

If you want to run your business smoothly in Hong Kong, you need to get the paperwork in place for obtaining registration.

But doing this on your own can be overwhelming, and that's why Air Corporate is here.

Air Corporate can assist you in obtaining the certificate and notify the registration office if there are any changes in the particulars.

Our team of experts clarifies your doubts and simplifies the business and company registration process so that you can get your hands on the certificate without any hassle.