Here are the frequently asked questions about the Business Registration Certificate in Hong Kong that can guide business owners when getting one:

1. What is a Business Registration Certificate?

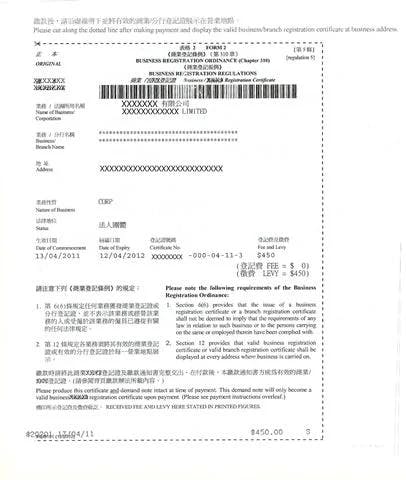

A Business Registration Certificate is an official document issued by the Business Registration Office of the Inland Revenue Department upon registration.

It contains all the details of a company, including its:

- Business registration number

- Company name

- Business name (if different from company name)

- Address

- Nature of business

- Date of company incorporation

- Expiry date of the BR Certificate

If you change any details of your business, you must report to the Business Registration Office within 30 days.

The registration number on the BR Certificate is also known as the tax identification number (TIN) of your company.

2. Which businesses need a Business Registration Certificate?

The Inland Revenue Department states that the following types of businesses and activities are required to be registered with the Business Registration Office:

- A local and non-Hong Kong company that has established a business in Hong Kong, regardless of whether there is any business activity carried out or not

- Overseas companies that have a representative or liaison office in Hong Kong

- Overseas companies that have let out their property based in Hong Kong, regardless of whether it has an established place of business in Hong Kong

- All types of trade, craftsmanship, commerce, profession, or activity carried out for gain

- Any club that provides services, facilities, and exclusive club premises to members for social interaction and recreational purposes

To keep it simple, all companies, sole proprietorships, or partnerships in Hong Kong need to register and pay a business registration fee to get a Business Registration Certificate.

Exemption

Some activities are exempt from registration. For example, charitable institutions approved under Section 88 of the Inland Revenue Ordinance do not need a Business Registration Certificate.

There is also an exemption for licensed hawkers, individual shoe polishers without employees, and some small-scale farming or fishing operations.

Most commercial activities, even informal ones, will still require registration unless clearly covered by these specific exemptions.

3. How can I obtain a Business Registration Certificate?

When you register a company in Hong Kong, you will automatically obtain a BRC as soon as it is incorporated. Even if it is issued by the Inland Revenue Department, it will be collected from the Hong Kong Companies Registry together with the Certificate of Incorporation.

If you register a sole proprietorship, you have to apply to the Business Registration Office to get your BRC.

The application process involves completing the ‘Request for Business Registration Application Form' (IRBR194) form and paying the required fee.

There are different forms depending on the structure of your business. All you have to do is select the option that applies to you and fill in the corresponding form.

Also, if you have a business at another branch, you will need to obtain a BRC for that branch.

4. Do I have to register my business name first?

You have to register a business name as part of the registration process.

It is advised by the Inland Revenue Department to either register a Chinese name only, an English name only, or register both a Chinese name and an English name.

Please note that your business name does not have to be the same as your company name.

5. What is a Business Registration Number?

A Business Registration Number (BRN) is a unique eight-digit number issued by the Inland Revenue Department (IRD) to identify a business registered in Hong Kong. This number appears on the Business Registration Certificate (BRC) and serves as the company’s Tax Identification Number (TIN).

The BRN is required when conducting business activity that is regulated by government bodies.

Many people confuse the BRN with the Company Registration Number (CRN), which the Companies Registry issues upon incorporation.

To understand the difference between both certificates in detail, please refer to our previous article on this topic.

6. Should I display the Business Registration Certificate for inspection?

Businesses in Hong Kong are legally required to display the original Business Registration Certificate at their principal place of business and all branches, allowing regulatory or government officers to inspect and verify it when necessary.

Always show the original certificate, not a copy, to prove you follow the rules.

- Builds Customer Trust: People feel safer buying from a business that follows the rules.

- Attracts Business Partners: Companies are more likely to work with you if they know you run a legal business.

- Reassures Employees: Workers feel more secure knowing they are part of a well-managed company.

Displaying the original BRC leaves a strong impression on customers. The rules for showing your certificate are simple. You must put it in a visible place at your business location so people can easily see it.

The BRC must be displayed as a physical copy. Failure to do so may result in a HK$5,000 fine or imprisonment for up to one year. Ensure it’s properly displayed to stay compliant.

7. What happens if I fail to comply?

Non-compliance can result in heavy fines if you fail to register on time or register too late.

If you register too late, you will have to pay a fee for all the years that you have not complied with, including any additional penalty that is imposed.

The Inland Revenue Department (IRD) charges a Business Registration Fee, and if you don’t follow the rules, you could be fined HK$5,000 or even go to jail. Make sure to register on time to avoid problems.

Non-compliance can cause significant disruptions to your business as you may face difficulty in filing tax returns.

8. Are there other licenses and permits needed?

It is important to note that along with a BR Certificate, you may need other licenses and permits to run your business.

These licenses and permits will depend on the nature of your business and business operations (e.g. food importation license, SFC license, money service operator license, and additional licenses, etc.).

9. When do I need to apply for a Business Registration Certificate?

Registering for a Business Registration Certificate (BRC) at the right time is important, but the timing depends on your business type:

- New Businesses: Must apply within one month of starting operations.

- Incorporated Companies: If registered under the Companies Ordinance, you can apply for a BRC at the same time as company incorporation using the One-Stop Registration Service, receiving both the Certificate of Incorporation and BRC together.

- Other Business Types: Sole proprietorships, partnerships, and branches must also complete registration within one month of beginning operations.

For example, sole proprietorships and partnerships must apply within one month of starting their business. Likewise, overseas companies opening a branch in Hong Kong must register within one month of setting up their business location.

10. How much does it cost to apply for a Business Registration Certificate in Hong Kong?

The Hong Kong government has revised the application fees for BRCs, but the HK$150 annual levy for the Protection of Wages on Insolvency Fund is waived until 2026. The updated fees are:

Standard Business Registration Certificate

- One-Year Certificate: HK$2,200

- Three-Year Certificate: HK$5,720

Branch Business Registration Certificate

- One-Year Certificate: HK$80

- Three-Year Certificate: HK$208

Ready to start your business in Hong Kong?

Register with Air Corporate today and get everything you need—anytime, anywhere.

You focus on your business. We’ll take care of the rest.