A share certificate is a document issued by a company to its shareholders, confirming their ownership of a specific number of shares. In Hong Kong, a certificate that states the shares held is proof of title unless there is evidence to the contrary under the Companies Ordinance (Cap. 622) s.137. It is commonly requested in legal and financial transactions and can support bank onboarding and investment due diligence.

A share certificate shows the member’s name, number and class of shares, certificate number, date, and execution. An address is optional.

The company issues certificates; the secretary typically prepares and administers them.

Certificates must be completed and ready for delivery within 2 months after an allotment, and for private companies within 2 months after a registered transfer under the Companies Ordinance (Cap. 622).

Valid execution includes two directors, or one director and the company secretary, or the sole director for a single-director company. Electronic signatures may be used if compliant with the Electronic Transactions Ordinance (Cap. 553) and the company’s articles.

The register of members is separate from certificates and must be kept at the registered office or a prescribed place in Hong Kong. If kept elsewhere, notify the Companies Registry of the place within 15 days.

Private companies handle lost or damaged certificates under their articles and board authority. Listed companies follow a statutory replacement process via the share registrar.

What Is a Share Certificate in Hong Kong?

A share certificate is a document issued by a company to a shareholder that evidences ownership of a specific number and class of shares.

It typically states the company name, the member’s name, the number and class of shares, the certificate number, the date, and proper execution.

Also, it is used in corporate records and transactions as evidence of title. It is not the same as the register of members.

What Information Is Included on a Share Certificate?

If you own shares of a company in Hong Kong, you should receive a share certificate with all details concerning your shares.

A Hong Kong share certificate normally includes:

- The issuing company’s full name

- The member’s name

- The number and class of shares

- The certificate number and date

- Proper execution in line with the Companies Ordinance (Cap. 622) and the company’s articles

A correspondence address is not legally required on the face of the certificate. Include only if your articles or house style require it.

If a member holds different classes, issue separate certificates for each class.

In addition, if transfer restrictions exist under a shareholders’ agreement, include a short reference if advised by counsel.

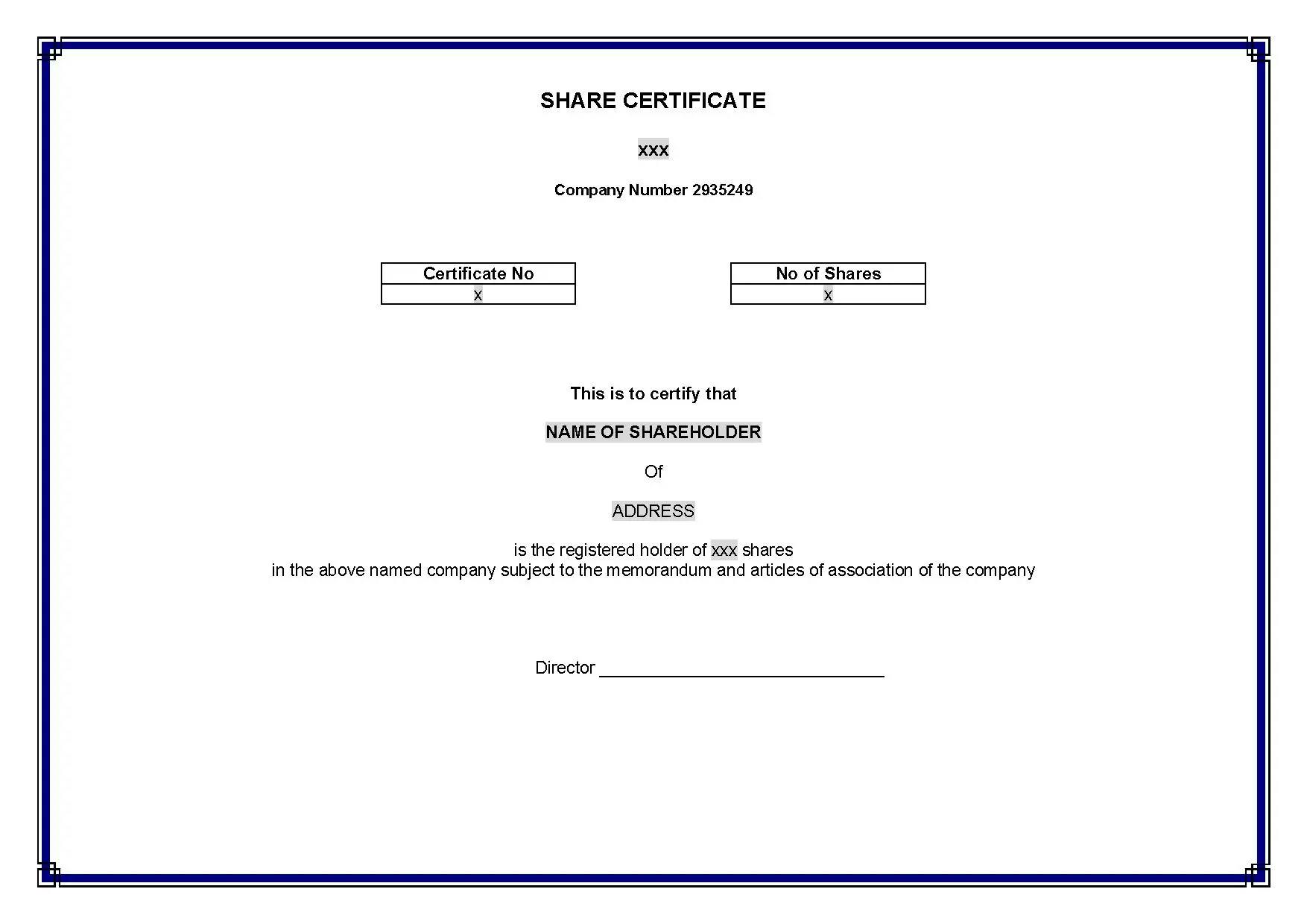

What Does a Shareholder Certificate Look Like?

There is no standard or prescribed format. Please refer to the picture below for a sample of a share certificate issued by a Hong Kong company.

Share certificates issued by companies in other jurisdictions (Singapore, BVI, Delaware) usually follow the same format.

Who Issues a Share Certificate?

The company issues the certificate. The company secretary typically prepares the paperwork, coordinates execution, and updates statutory records.

How to Sign a Share Certificate

Upon issuance, a share certificate shall be signed by:

- Two directors; or

- One director and the company secretary; or

- The sole director for a single-director company.

Electronic signatures may be used where appropriate and agreed, consistent with the Electronic Transactions Ordinance (Cap. 553) and the company’s articles.

When to Issue Share Certificates?

There are various occasions in which a Hong Kong company may issue share certificates to its shareholders:

Incorporation

Founding members receive certificates once the company is incorporated and entries are made in the register of members.

Share Transfers

For private companies, after a transfer is lodged and the board approves registration, the company must register the transfer or send a refusal notice within 2 months of lodgment (Companies Ordinance (Cap. 622 s.151).

If registered, the company must have the new certificates ready for delivery within 2 months of lodgment (Cap. 622 s.155(2)(a)).

The seller’s original certificate is canceled and, if only part of the holding is sold, a balance certificate is issued to the seller.

Share Allotments

When the company allots new shares, certificates must be completed and ready for delivery within 2 months after the allotment (Companies Ordinance (Cap. 622 s.144).

Replacement of a Lost or Damaged Share Certificate

The replacement process differs for private and listed companies.

Private Companies

Handled by the company under its articles and board authority:

- Written notice from the member describing the loss or damage.

- Evidence of loss, such as an affidavit or statutory declaration, and any requested identification.

- Indemnity from the member in a form the board approves, and payment of any fee set by the company.

- Board approval and issue of a replacement certificate clearly marked “replacement,” with the register of members updated accordingly.

Listed Companies

A statutory procedure applies that typically involves public notices and a waiting period. Shareholders interact with the listed company’s share registrar.

How to Keep Your Share Certificate Safe?

Because a share certificate is evidence of title, it should be kept in a secure place.

To reduce the risk of loss, many companies keep original share certificates with the company secretary (or a designated custodian) together with the company’s statutory records, with clear internal controls for access and release.

If you need a working copy, you can request a certified true copy.

Some banks or counterparties may require certification by a solicitor, CPA, or notary depending on their requirements.

What Is the Difference Between a Share Certificate and a Register of Members?

The register of members is the company’s statutory record of all registered shareholders, showing (among other prescribed particulars) their names, addresses, shareholdings, and the dates they became or ceased to be members.

It must be kept at the registered office or a prescribed place in Hong Kong.

If it is kept somewhere other than the registered office, notify the Companies Registry within 15 days and notify again if the place changes (Cap. 622 s.628).

A share certificate is an individual document issued to a specific member as evidence of title at a point in time. It is proof of title in the absence of contrary evidence (Cap. 622 s.137).

What Is the Difference Between a Share Certificate and a Certificate of Incumbency?

In Hong Kong, counterparties usually rely on Companies Registry searches (for example a Company Particulars Report) and a company secretary’s certificate to verify officers, authority, and shareholdings.

A “certificate of incumbency” is an offshore concept used in jurisdictions such as BVI or Cayman.

By contrast, a share certificate is issued by the company to a specific shareholder as evidence of title to a stated number or class of shares.

When Is a Share Certificate Canceled?

When a shareholder transfers shares or a replacement certificate is issued, the original share certificate is typically treated as no longer valid and is surrendered to the company for cancellation in accordance with the company’s articles and internal procedures.

The company (often through the company secretary) shall take care of canceling such a share certificate, usually marks the certificate “Cancelled” and retains it in its records.

Update the register of members within statutory timelines:

- Allotments: register within 2 months (Cap. 622 s.143, entries required under s.627).

- Transfers: within 2 months of lodgment, either register the transfer or send a refusal notice (Cap. 622 s.151).

For listed companies, cancellation can also occur under the statutory lost-certificate replacement process, which includes public notices and the issue of a new certificate.

Last Words on Share Certificate Hong Kong

Share certificates confirm share ownership and are part of your core corporate records in Hong Kong. Follow the 2-month issuance deadlines, execute correctly under the Companies Ordinance (Cap. 622), and keep the register of members up to date.

For private companies, handle lost or damaged certificates through board authority and appropriate evidence and indemnities.

Need help preparing board papers, updating the register of members, and issuing certificates on time? Air Corporate can manage the end-to-end process so you can focus on your business.

FAQs

For transfers of Hong Kong stock: stamp duty 0.1% per side + HK$5 (or 0.2% + HK$5 for voluntary dispositions). Private companies mainly incur internal admin/printing; listed shares may also have broker and share registrar/transfer agent fees.

Mostly terminology. Hong Kong uses “share certificate” (proof of title under Cap. 622 s.137); the U.S. commonly says “stock certificate.” Both evidence equity ownership.

HKEX runs the markets and enforces Listing Rules for listed issuers; the SFC is the statutory regulator under Cap. 571. HKEX doesn’t regulate unlisted companies.