A Certificate of Incumbency (also known as an incumbency certificate) is a document issued by an independent third party to confirm certain information about a company. It is usually signed by a regulated professional such as a company secretary, lawyer, public notary, or certified public accountant.

A Certificate of Incumbency confirms (i) the fact that a company exists and is in good standing and (ii) the identities and positions of company directors and officers, affirming their authority to act on behalf of the organization.

The document usually includes information such as company name, directors, shareholders, secretary, ultimate beneficial owners, incorporation date, registered address, business address, share capital, and number of shares.

It is usually required to open bank accounts and apply for loans or public subsidies.

Obtaining a Certificate of Incumbency can be an easy process if you have the right business support.

It’s still a crucial document in your company’s formation, and you should read on to know what goes behind a Certificate of Incumbency.

In this article, we'll discuss the meaning of the certificate of incumbency, its importance, and how to get one!

What Is a Certificate of Incumbency?

A Certificate of Incumbency is a legal document issued to independently verify and confirm certain information about a company, its management, and the persons who have the authority to act on its behalf.

This information usually includes:

- Name of your company

- Identity of its directors

- Identity of its shareholders

- Identity of its elected and acting secretary

- Identity of its ultimate beneficial owners (also known as UBO)

- Date of incorporation

- Registered address

- Business address (if different from your registered address)

- Amount and currency of its share capital

- Number of shares

There is no prescribed format or standard wording for a certificate of incumbency.

If there is some specific information that you need to see reflected in the certificate, it is better that you expressly inform the third party that will prepare it.

Why Do You Need a Certificate of Incumbency?

In many circumstances, a Certificate of Incumbency will be required by a third party that needs to obtain official confirmation about some company’s information.

Here are some examples:

| Purpose | Details |

|---|---|

| Opening of a bank account | When your company applies for the opening of a bank account in Hong Kong (with HSBC, DBS, Bank of China, or Hang Seng Bank), the bank usually requires that you present an incumbency certificate in order to confirm the particulars of your company. |

| Applying for a loan | A bank may also request that you provide a certificate of incumbency when your company applies for a loan as part of a background check. |

| Applying for a public subsidy | The government may ask for a certificate of incumbency before a public subsidy can be awarded to your company. |

| Visa application | Certain jurisdictions may ask for a certificate of incumbency when your company applies for a business visa for some of your employees or legal representatives. |

Who Can Issue a Certificate of Incumbency?

There is no legal prescription on who can issue a certificate of incumbency for a Hong Kong company.

Always check carefully the specific requirements of the Certificate of Incumbency that you are requested to provide before engaging a professional to issue it.

A person asking for a certificate of incumbency regarding your company will usually expect that it is issued by an independent third party (meaning by a person who is not a shareholder, director, or employee of your company).

It is also expected that the independent third party is a regulated professional.

In Hong Kong, this includes company secretaries, lawyers, public notaries, or certified public accountants.

You should also know that the Hong Kong Companies Registry can issue a document equivalent to a certificate of incumbency, which is known as a Hong Kong Company Particulars Report.

A Hong Kong Company Particulars Report issued by the Company Registry provides a summary of the key information about any HK company (i.e., registered office address, principal place of business, share capital, name of current directors).

You can obtain a Company Particulars Report on the Companies Registry website at a cost of HKD 22. However, the Hong Kong Company Particulars Report does not include updated information about your company's shareholders or ultimate beneficial owners.

This is why you may still need the services of an independent professional third party when required to produce a Certificate of Incumbency for your HK company.

What Does a Certificate of Incumbency Show?

The content of a Certificate of Incumbency usually differs depending on the third party requesting it. In most cases, it will include basic information about your company.

It shows a snapshot of the information included in the bylaws (Articles of Association) and the statutory books of a company (registers of members, directors, secretaries, and ultimate beneficial owners).

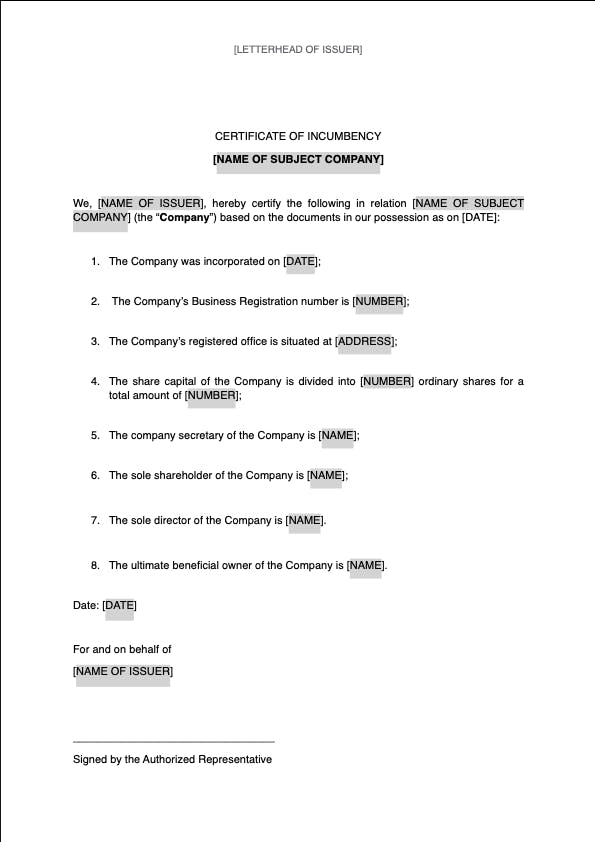

Example of an Incumbency Certificate

Although they may take various forms, a typical Incumbency Certificate issued upon registration of a company and for opening a bank account will look similar to the following:

Does a Certificate of Incumbency Expire?

A Certificate of Incumbency does not expire.

However, you will be periodically requested to provide your Certificate of Incumbency, which is not older than 3 months.

Does a Certificate of Incumbency Need to Be Notarized?

If your company's certificate of incumbency is issued by a regulated professional (lawyer or CPA), it is unusual to require the certificate to be notarized.

In case the certificate of incumbency is issued by a third party other than a regulated professional, you may still be required to have it notarized.

In this case, it is more efficient to arrange the preparation of the certificate by a public notary from the beginning.

Where Can You Get a Certificate of Incumbency?

At Air Corporate, we can help issue your Hong Kong company Certificate of Incumbency.

Some of our team members include regulated professionals such as lawyers and CPAs who can issue any type of certificate of incumbency.

We also provide our assistance if you need to obtain your Company Particulars Report with the Companies Registry.

If you register your company with Air Corporate or appoint us as your Hong Kong company secretary, our service includes the preparation and issuance of 1 certificate of incumbency for your Hong Kong company.

FAQs

A Certificate of Incumbency normally contains the company’s name and location as well as the titles, addresses, and signatures of the current officers and directors. It could also have details on the individuals who are permitted to sign documents on the company’s behalf as well as the officers’ and directors’ power to do so.

The time it takes to obtain a Certificate of Incumbency can vary depending on the jurisdiction and the complexity of your company’s organizational structure. In most cases, it may be possible to obtain a certificate in a matter of days.

No, a Certificate of Incumbency is not the same as a Certificate of Good Standing. An organization’s ability to conduct business in a certain state and compliance with all relevant state rules and regulations will both be certified by a Certificate of Good Standing. However, a Certificate of Incumbency is certified by the legitimacy of a company’s executives and directors as well as their positions and power.