Relevant entities that carry on a relevant activity must meet the economic substance test each year and report through the official portals

Pure equity holding companies have a reduced test focused on applicable Cayman filings and adequate human resources and premises in Cayman appropriate to holding/managing equity participations.

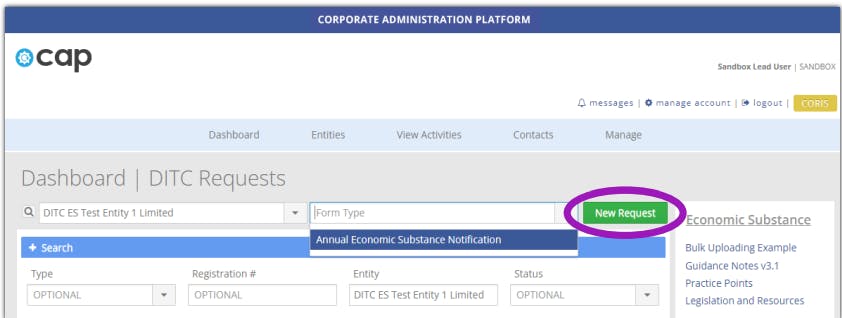

The Economic Substance Notification (ESN) is filed on the CAP portal and is a prerequisite to the annual return. Due by 31 March each year.

The Economic Substance Return (ESR) is filed on the DITC Portal within 12 months after financial year end.

Penalties include KYD 10,000 on a first failure, KYD 100,000 on a second consecutive failure, KYD 5,000 for late ESR plus KYD 500 per day, and criminal offences for false or misleading information.

Overview of Economic Substance Rules in the Cayman Islands

The regime is set out in the International Tax Co-operation (Economic Substance) Act and detailed in Economic Substance Guidance Notes v3.2 (July 2022) and the TIA Enforcement Guidelines (31 March 2022). These define who is in scope, the nine relevant activities, the economic substance test, and how filings are made.

Oversight sits with the Tax Information Authority (TIA), which operates through the Department for International Tax Cooperation (DITC). All filings are made through the CAP and DITC Portal systems.

Who Is in Scope (and Who Is Not)

In Scope: “Relevant Entities”

- Companies under the Companies Act

- Limited Liability Companies (LLCs) under the Limited Liability Companies Act

- Limited Liability Partnerships (LLPs) and partnerships (where applicable)

- Foreign companies registered in the Cayman Islands

Out of Scope or Excluded

- Investment funds (as defined) and entities through which a fund invests or operates

- Domestic companies only doing business in Cayman and meeting the domestic criteria

- Entities that are tax resident outside Cayman and file a Tax Resident Outside the Islands Form (TRO Form) with evidence via the DITC Portal

What Counts as a “Relevant Activity”

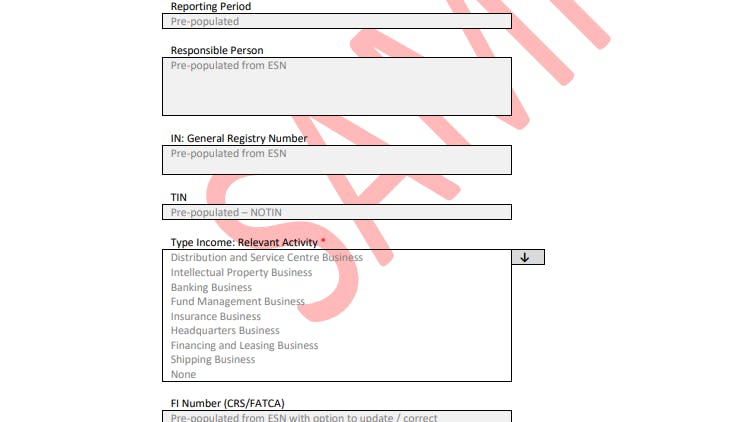

There are nine categories: banking, insurance, fund management, financing and leasing, distribution and service centre, headquarters, shipping, holding company business, and intellectual property business. The Guidance provides Core Income Generating Activity (CIGA) examples for each.

If you conduct more than one relevant activity, assess each activity separately for the test and in your ESR.

The Economic Substance Tests

The Standard Test

You must demonstrate in Cayman:

- Direction and management in Cayman (board knowledge, meetings with quorum in Cayman, minutes and records kept in Cayman).

- Adequacy of expenditure, employees, and premises in Cayman.

- Core Income Generating Activities (CIGAs) performed in Cayman. Outsourcing is allowed in Cayman if you monitor and control the provider.

Reduced Test for Pure Equity Holding Companies

A pure equity holding company satisfies a reduced test by:

- Complying with applicable Companies Act filing and record-keeping requirements, and

- Having adequate human resources and premises in Cayman appropriate to holding and managing equity participations.

Unlike other entities, a pure equity holding company does not need to be directed and managed in Cayman, but it must maintain sufficient local substance for its holding activity.

No Relevant Income in the Year

If a relevant entity conducts a relevant activity but earns no relevant income during the financial year, the economic substance test does not apply for that period.

However, the entity must still:

- File its Economic Substance Notification (ESN), and

- Submit a nil Economic Substance Return (ESR) if a relevant activity was carried on during the year.

Air Corporate can provide Cayman-based company secretarial support and ensure board minutes and registers are maintained to evidence direction and management.

What to File, Where, and When (2026 Cayman Economic Substance Deadlines)

| Filing | Who Must File | Where to File | Deadline |

|---|---|---|---|

| Economic Substance Notification (ESN) | All entities in scope of the Economic Substance Act (including partnerships noted in the Guidance) | CAP Portal (General Registry) | By 31 March each year – required before submitting the Annual Return |

| Economic Substance Return (ESR) | Relevant entities that carried on a relevant activity during the year | DITC Portal | Within 12 months after the financial year end |

| TRO Form (Tax Resident Outside Cayman) | Entities claiming foreign tax residence | DITC Portal | Within 12 months after the financial year end, with supporting evidence (e.g., certificate of tax residence) |

ESN: What It Includes

The Economic Substance Notification (ESN) provides essential details such as:

- Entity type and relevant-entity status

- Whether any relevant activity was conducted

- Financial year details

- For tax-resident entities abroad: parent, ultimate beneficial owner (UBO) information, and foreign jurisdiction details

This filing is mandatory for all entities, even if no income was earned.

ESR: What It Includes

The Economic Substance Return (ESR) discloses your:

- Relevant activities and relevant income

- Cayman expenditure, employees, and premises

- Core Income Generating Activities (CIGAs) performed in Cayman

- Extra data for high-risk IP businesses and MNE Groups (revenue USD 850 million or above)

The ESR must be submitted electronically on the DITC Portal within 12 months of the entity’s financial year end.

TRO: When Claiming Tax Residence Abroad

If your entity is tax resident outside the Cayman Islands (TRO), you must file the TRO Form on the DITC Portal, supported by evidence such as a valid certificate of tax residence from the foreign jurisdiction.

Exchange of Information

Where an entity fails the economic substance test or is a high-risk IP business, the Tax Information Authority (TIA) may exchange information with competent authorities in the jurisdiction of tax residence, the parent, ultimate parent, or UBO jurisdiction, consistent with international standards.

Penalties and Enforcement

- Failure to satisfy the ES test: KYD 10,000 on the first determination; KYD 100,000 on a consecutive failure. The Grand Court may order remedial steps or strike-off.

- Late ESR filing: KYD 5,000 plus KYD 500 per day until filed.

- False or misleading information: offence punishable by a KYD 10,000 fine and/or up to five years’ imprisonment.

Active enforcement follows the TIA Enforcement Guidelines (31 March 2022).

Practical Checklist

- Confirm if you are a relevant entity and whether you carry on a relevant activity.

- Map CIGAs and confirm direction and management and adequacy are demonstrable in Cayman.

- If pure equity holding, apply the reduced test and ensure basic local resourcing is in place.

- File ESN on CAP by 31 March.

- File ESR and, if applicable, TRO on the DITC Portal within 12 months after your financial year end.

- Keep minutes, registers, and service contracts in Cayman to support your filing positions.

Conclusion

The economic substance rules in the Cayman Islands aren’t something to ignore — every company is expected to prove it has real activity or file the right declarations each year. Staying compliant means keeping your filings on time, your records in order, and your Cayman presence easy to demonstrate if asked by the Tax Information Authority (TIA).

If you’re thinking of setting up a Cayman company, Air Corporate can walk you through everything — from registration and local office setup to keeping your structure compliant under the latest ES requirements.

FAQs

The economic substance in the Cayman Islands refers to the legal requirement for certain entities conducting relevant business activities to have a real physical presence, including local management, employees, and premises, and to carry out core income-generating activities within the Islands.

The economic substance requirement is the obligation for companies engaged in specified business activities to demonstrate that they have adequate physical operations, staff, and decision-making in the jurisdiction where they are incorporated.

To open a business in the Cayman Islands, you need to register with the General Registry, obtain necessary licenses (like a Trade and Business License), provide due diligence documents, comply with local regulations, and, for certain sectors, meet economic substance or local ownership requirements.

The Cayman Islands economy is service-driven and highly developed, anchored by financial services, tourism, and real estate. It maintains no direct taxes on income, profits, or capital gains.

GDP per capita is among the highest in the Caribbean, supported by a stable regulatory system under the Cayman Islands Monetary Authority (CIMA) and strong compliance with international financial standards.