Excellent

Excellent customer service and no…

Excellent customer service and no hidden fees. Very transparent. I recommend air-corporate to everyone.

Nazil Afeef

2023-02-06

I really appreciate Vivian’s honesty…

I really appreciate Vivian’s honesty and transparency that’s why we choose air corporate at the end. Compared to other companies air corporate is much more personal and their customer service is phenomenal 🙂

Lukas

2023-02-10

Really smooth experience

Vivian offered extremely helpful preliminary advice and oversaw a surprisingly smooth process. Customer service made the decision to go with Air Corporate an easy one and I will use them again.

Jon Boyd Underland

2023-12-06

1,000+ Bank Accounts Opened

With over 10 years of experience, we’ve helped clients worldwide secure the right offshore banking solution, quickly and securely.

100% Online & Remote

Register your offshore company and open a business bank account without setting foot in the jurisdiction. We handle the process remotely from start to finish.

Tailored Banking Guidance

There’s no one-size-fits-all approach in offshore banking. We help you choose the most suitable provider based on your business model, industry, and operational needs.

Banking Included with Company Formation

Most of our company formation packages come with corporate bank account support included, making setup seamless and cost-effective.

Preferred Access to Trusted Partners

Thanks to our strong relationships with 5+ leading banks and fintech providers, our clients benefit from faster approvals and smoother onboarding.

Can You Really Do Business Without a Bank Account?

Incorporating offshore is just the first step. Banking is what keeps your business moving. Without the right account, you risk delays in payments, missed opportunities, and limited global reach.

The problem? Offshore banking isn’t always straightforward. Opening an account on your own can take months, and still lead to rejection.

That’s where we come in. With our established banking network and deep industry experience, we reduce wait times dramatically, often securing approvals in just a few weeks or less. We help you choose the right institution, prepare your application, and manage the process from start to finish.

Why Offshore Banking Makes Sense

- ✓

Access to international markets for trade, investment, and expansion

- ✓

No currency restrictions, move funds freely across borders

- ✓

Multi-currency support (USD, EUR, GBP, SGD, HKD, AUD, and more)

- ✓

Protection of assets from economic or political instability at home

- ✓

Enhanced privacy with stronger data confidentiality protocols

- ✓

Tailored banking solutions for international businesses and investors

- ✓

24/7 access to your funds via online banking, cards, and mobile apps

Multiple Banking and Payment Options

Open the account(s) you need*

Traditional banks

Online banks

Merchant accounts for e-sellers

Physical and virtual credit cards

* the list of institutions and products therein is non-exhaustive and indicative only

How It Works

Set Up Your Offshore Company

Apply for Your Offshore Bank Account

We help you prepare and submit your banking application with the right financial institution (traditional bank or fintech), based on your business profile.

Start Transacting Globally

Once approved, you can send and receive payments worldwide in multiple currencies, with full access to online banking and card services.

1,000+

Bank Accounts Opened

800+

Companies registered

50+

Industries Covered

25+

Nationalities

Banking

Banking support & options

Use these comparisons as a starting point. Final requirements depend on your structure, activity, and risk profile.

Showing 28 results.

Traditional bank comparison

This table is long. Use filters above, then expand to view full results.

Showing 28 results.

Preview

Belize

Belize Bank

Belize

Caye International Bank Ltd.

Belize

Heritage Bank

British Virgin Islands

First Caribbean International Bank

Cayman Islands

Cayman National Bank

Cayman Islands

Butterfield Bank (Cayman) Limited

Show full tableHide full tableBest for detailed comparisons after filtering.

“Remote opening” is inferred from whether a personal visit is required. Always confirm with the bank before applying.

Documents you may need

Exact requirements depend on the institution and your structure. Most applications request the following.

- Completed KYC (Know Your Customer) form

- Recent bank statements

- A bank reference letter

- CVs or professional profiles of directors and shareholders

- A clear business plan outlining your activities

- Trading history or supporting documents (e.g., invoices, contracts)

- Information on key clients, suppliers, or partners

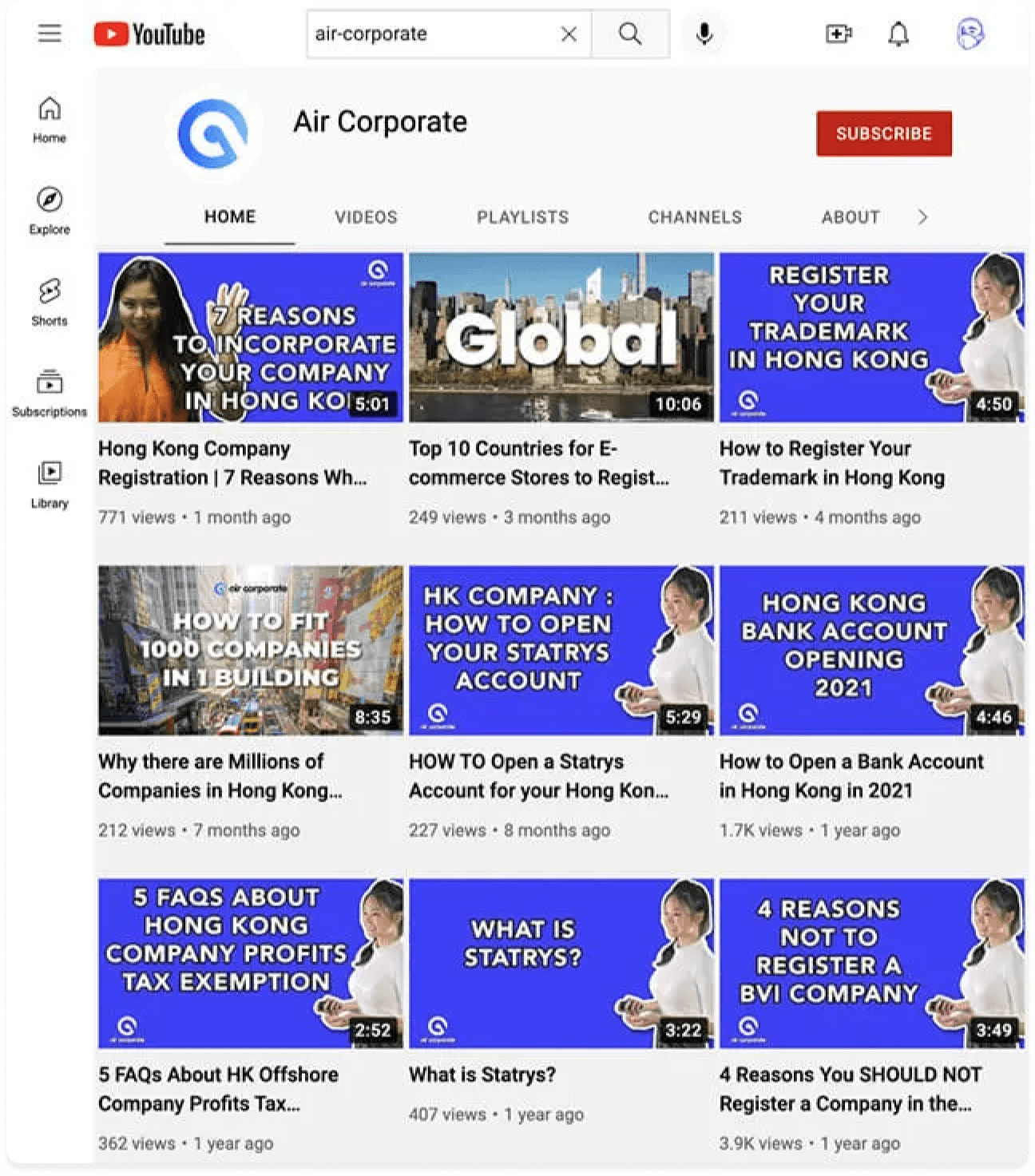

Learn with us on YouTube

Our YouTube channel is your gateway to valuable insights

Our experienced team has assisted countless entrepreneurs, businesses, and SMEs in navigating the complexities of the Asian business landscape through our informative videos and tutorials.

FAQs

Yes, opening an offshore bank account is completely legal, provided you comply with the reporting and tax obligations in your home country. Offshore banking is widely used by international businesses, investors, and entrepreneurs for practical reasons like currency flexibility, asset protection, and global reach.

Yes, opening an offshore bank account is completely legal, provided you comply with the reporting and tax obligations in your home country. Offshore banking is widely used by international businesses, investors, and entrepreneurs for practical reasons like currency flexibility, asset protection, and global reach.

In most cases, no physical visit is required. Thanks to our network of offshore-friendly banks and fintech providers, you can open your account 100% remotely, depending on your chosen jurisdiction and bank.

In most cases, no physical visit is required. Thanks to our network of offshore-friendly banks and fintech providers, you can open your account 100% remotely, depending on your chosen jurisdiction and bank.

Timeframes vary by bank and your company’s risk profile, but most accounts can be opened in 2 to 4 weeks with our support. We help streamline the process and avoid unnecessary delays.

Timeframes vary by bank and your company’s risk profile, but most accounts can be opened in 2 to 4 weeks with our support. We help streamline the process and avoid unnecessary delays.

We assist with business (corporate) accounts that support:

- Multi-currency transactions

- Online banking access

- Debit/credit card facilities

- International wire transfers

We assist with business (corporate) accounts that support:

- Multi-currency transactions

- Online banking access

- Debit/credit card facilities

- International wire transfers

Yes, we work with both traditional banks and modern fintech providers. Depending on your business model and jurisdiction, a fintech option may offer faster onboarding and greater flexibility.

Yes, we work with both traditional banks and modern fintech providers. Depending on your business model and jurisdiction, a fintech option may offer faster onboarding and greater flexibility.

We only work with reputable, licensed financial institutions in stable jurisdictions. While every banking relationship carries risk, we help you choose secure and compliant options that align with your goals.

We only work with reputable, licensed financial institutions in stable jurisdictions. While every banking relationship carries risk, we help you choose secure and compliant options that align with your goals.

They succeeded with Air Corporate

Trusted by 1,000+ entrepreneurs and SMEs