A share certificate is a document issued by a company to its shareholders, confirming their ownership of a specific number of shares in the company.

Share Certificates contain the company name, shareholder's name and contact information, number of shares held, class/type of shares, and a unique share certificate number.

It is issued by the company secretary and signed by at least two directors, or one if the company has a sole director.

The timing of issuance should be during incorporation, share transfers, share allotments, or to replace lost certificates.

Keep certificates in a safe place, preferably with the company secretary, and obtain certified copies.

A certificate of incumbency is issued by a third party to confirm company details, while a share certificate is issued by the company.

Share certificates are canceled when a shareholder ceases to hold shares, and the register of members is updated accordingly.

Any shareholder receives a share certificate at the time of an investment in a company.

This document is absolutely crucial as it evidences the shareholders' ownership and participation in a company.

If you hold shares in a Hong Kong company, this guide explains everything you must know about your share certificate.

What Is a Share Certificate?

A share certificate is a document issued by a company to its shareholders, confirming their ownership of a specific number of shares in the company. It serves as evidence of the shareholder's equity interest in the company and typically includes details such as the company's name, the shareholder's name and contact information, the number of shares held, the class or type of shares, and a unique share certificate number.

The document is also essential for legal and financial transactions and is frequently required for third-party financial agreements.

What Information Is Included On a Share Certificate?

If you own shares of a company in Hong Kong, you should receive a share certificate with all details concerning your shares.

A share certificate normally includes the following information:

- The issuing company's full name

- The shareholder's names and contact address

- Information on the number of shares held

- The classes or type of shares

- The share certificate number

A share certificate may include various other information.

For example, if a shareholder is restricted from selling its shares (based on the provisions of a Shareholders Agreement), it is generally a good idea to include a reference to this restriction on the share certificate.

If a shareholder holds different classes of shares of a company (for example ordinary and preference shares), it is recommended to issue separate share certificates for each class.

In the context of preference shares, it is also advised to include a brief description of the rights attached to such shares on the share certificate.

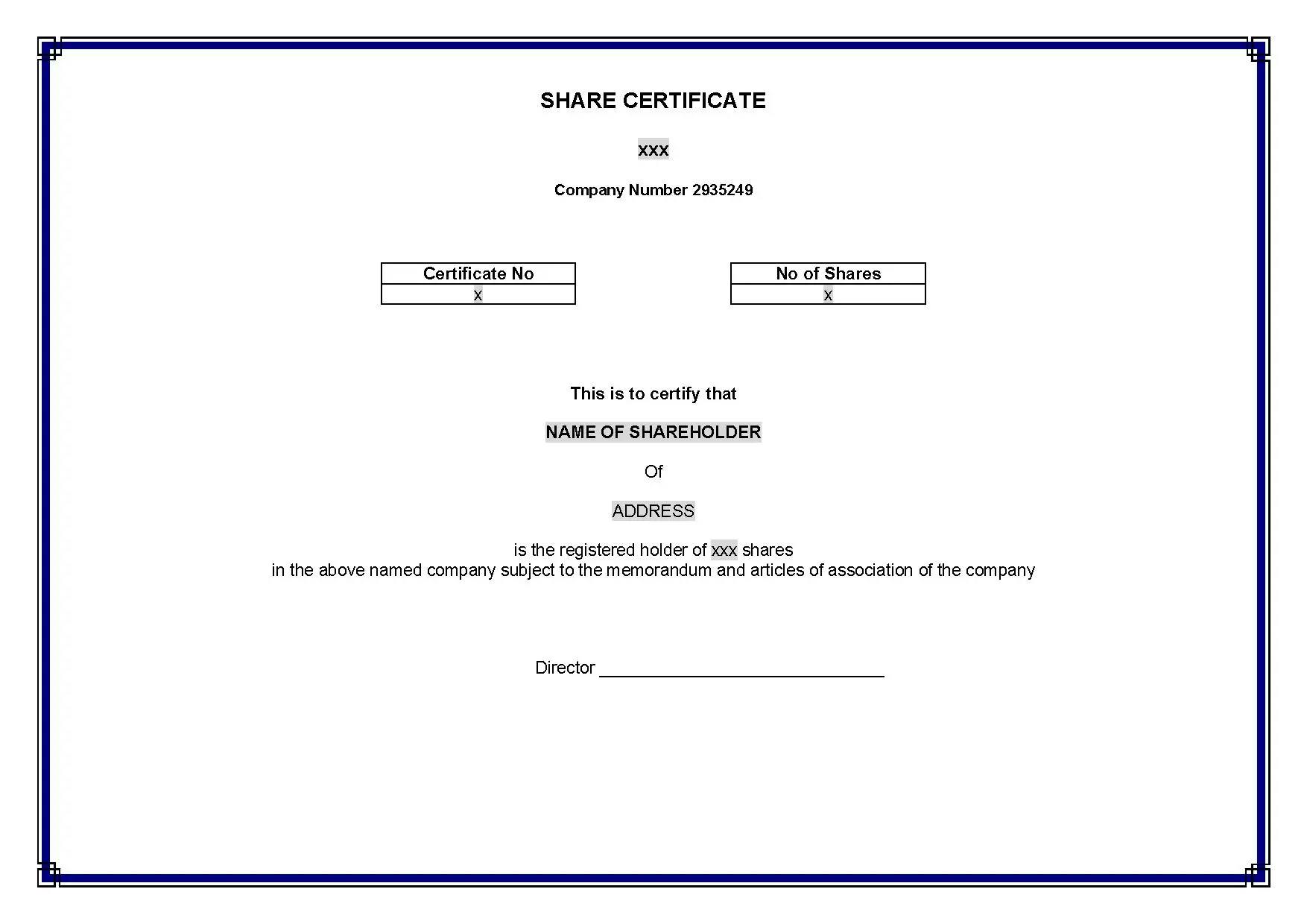

What Does a Shareholder Certificate Look Like?

There is no standard or prescribed format. Please refer to the picture below for a sample of a share certificate issued by a Hong Kong company.

Share certificates issued by companies in other jurisdictions (Singapore, BVI, Delaware) usually follow the same format.

Who Issues a Share Certificate?

A share certificate is usually prepared by the company secretary.

The company secretary normally also takes care of preparing all documents leading to the issuance of new share certificates (share allotment or share transfer documents).

Upon issuance, a share certificate shall be signed by at least two directors.

If the company has a sole director, then only one signature is required.

When to Issue Share Certificates?

There are various occasions in which a Hong Kong company may issue share certificates to its shareholders:

- Incorporation: Upon registration of a Hong Kong company, all its founding shareholders will receive a share certificate.

- Share transfers: When a shareholder transfers all of its shares to a purchaser, the company will issue a new share certificate for such shares in the name of the purchaser. The share certificate of the seller will be canceled. If the seller only sells part (but not all) of its shares, the original share certificate will be canceled and replaced by a new share certificate representing the number of shares still owned by such shareholder.

- Shares allotment: When a company allots new shares to existing or new shareholders, new share certificates will be issued accordingly.

- Loss of share certificates: Lost share certificates of a private company have no formal procedure for replacement. We recommend that you contact your company secretary who will be in charge of the reissuance of a new certificate.

How Replacement Share Certificate Works

To replace a lost, stolen, or damaged share certificate, follow these steps:

- Contact the company's transfer agent, found on their website or investor relations page.

- Inform them of the situation and provide your details and any information about the missing certificate.

- Request a replacement certificate and fill out any required application forms.

- Provide additional documentation like an affidavit of loss or proof of ownership if necessary.

- Pay any associated fees for the replacement.

- Receive the replacement certificate, which may take several weeks.

- Remember, some companies offer dematerialized shares, so you may not receive a physical certificate. Seek professional advice if needed.

How to Keep Your Share Certificate Safe?

It is strongly advised to keep the share certificates of a company in a safe place.

To reduce the risks of loss, we recommend that your company secretary keep such share certificates at its office together with the company's statutory records.

You may also ask your company secretary to provide you with a certified true copy of such share certificates.

What Is the Difference Between a Share Certificate and Register of Members?

The register of members of a Hong Kong company is a single document (usually a table) listing all registered shareholders of a company, their respective number of shares, and the date on which they became or ceased to be shareholders of the company.

This document provides a comprehensive overview of a company's past and current shareholding structure.

On the contrary, a share certificate only evidences the ownership by a shareholder of a certain number of shares at a certain point in time.

What Is the Difference Between a Share Certificate and a Certificate of Incumbency?

A certificate of incumbency is a document issued by a regulated third party (lawyer, public notary) and confirming certain information about a company such as its shareholders, ultimate beneficial owners, and directors.

It is normally required when a company applies for the opening of a bank account, a public subsidy, or a loan.

By contrast, a share certificate is issued by a company itself rather than by an independent third party.

When Is a Share Certificate Canceled?

When a person ceases to be a shareholder of a company, it shall return its share certificate to such a company.

An officer of the company (usually its company secretary) shall take care of canceling such share certificate, usually by affixing a “Canceled” stamp on the certificate.

This officer will then update the company's register of members to reflect the date on which such shareholders ceased to own shares of the company.

Last Words on Share Certificate Hong Kong

In conclusion, share certificates play a pivotal role in confirming share ownership and participation in a Hong Kong company. They encapsulate crucial details such as the company's name, shareholder information, share classes, and certificate number. Issued by the company secretary and signed by directors, share certificates mark significant events like incorporation, share transfers, and allotments. Safeguarding these certificates is essential, and keeping them with the company secretary or obtaining certified copies can mitigate the risk of loss.

Have not yet registered your Hong Kong company or opened your business account? Check our step-by-step guide to registering a company in Hong Kong.

Focus on your business, we take care of the rest.

FAQs

Determining the administration costs for issuing share certificates in Hong Kong depends on factors like the number of certificates, company size, and third-party involvement. Potential costs include government stamp duty, company secretary fees, printing, postage, and additional expenses for legal or registrar services. It's essential to consult with a professional for an accurate cost breakdown tailored to your situation.

Essentially, there's no real distinction between a share certificate and a stock certificate. Both terms are used interchangeably to denote the same document: a written proof of ownership issued by a company to an investor, indicating the ownership of a specific number of shares in the company.

The Hong Kong Stock Exchange (HKEX) is pivotal in Hong Kong's financial landscape by:

- Enabling capital raising: It provides a platform for companies worldwide to list shares, raising capital for growth and expansion.

- Facilitating securities trading: Investors can trade equities, debt securities, structured products, and derivatives on the HKEX.

- Ensuring market fairness: Through regulatory standards, it monitors trading to prevent malpractice and provides transparent market data.

- Connecting investors: Programs like Stock Connect link Hong Kong and mainland China markets, offering diverse investment opportunities.

In summary, the HKEX fosters economic growth, encourages investment, and solidifies Hong Kong's status as a global financial hub.