Since 27 December 2023, Hong Kong uses the Business Registration Number (BRN) as the Unique Business Identifier (UBI) across Companies Registry records. For companies formed on or after that date, the BRN appears as the “No.” on new certificates.

The BRN (UBI) also serves as your Tax Identification Number (TIN) for entities. It is the first 8 digits of the Business Registration Certificate number.

Failing to comply with the Business Registration Ordinance (BRO) can lead to a fine of HKD 5,000 and up to 1 year in prison.

In Hong Kong, there is a clear line between a company and a business. The CRN was historically issued by the Companies Registry. The BRN is issued by the IRD and is now the UBI used across CR records.

Hong Kong Company Registration Number (CRN)

Company registration means officially setting up a company with the Companies Registry under the Companies Ordinance. Under the UBI regime, the BRN has replaced the former CRN as the main identifier displayed on new certificates. Older companies may still have a CRN on historical documents, but CR searches map the former CRN to the BRN.

Documents Needed to Get a CRN in Hong Kong

| Requirement | Local Company | Non-Hong Kong Company |

|---|---|---|

| Application Form | Form NNC1 (limited by shares) or NNC1G (not limited) | Form NN1 |

| Articles of Association | Required | Included in certified constitutional documents |

| Notice to Business Registration Office | IRBR1 | IRBR2 |

| Other documents | — | Certified copy of charter/statutes/memorandum and articles; certificate of incorporation (foreign); latest published accounts where applicable |

| Certificates issued upon approval | Certificate of Incorporation + Business Registration Certificate (BRC) | Certificate of Registration + BRC |

File these documents with the required fees electronically via the e-Services Portal or in hard copy to the Companies Registry. Under the one-stop company and business registration service, incorporation and business registration are handled together.

Sole proprietorships and general partnerships are not required to have a CRN. They still need a BRN.

Hong Kong Business Registration Number (BRN)

The BRN identifies your business for tax and government purposes. It is required on tax forms and in day-to-day dealings with government bodies. The BRN is the first 8 digits of the Business Registration Certificate number.

You can apply online or in person. Local companies and non-Hong Kong companies use the one-stop flow at the CR, while other business types apply directly to IRD.

Documents Needed to Get a BRN in Hong Kong

| Category | Local Companies | Non-Hong Kong Companies |

|---|---|---|

| Required Documents | Incorporation Form NNC1 or NNC1G, IRBR1, Articles of Association | Form NN1 with relevant constitution documents, IRBR2 |

| Where to file | Companies Registry (one-stop) | Companies Registry (one-stop) |

| Fees | 1-Year BRC: HKD 2,200 fee, levy waived 1 Apr 2024 to 31 Mar 2026. 3-Year BRC: HKD 5,720 fee, levy HKD 150 if the commencement date is between 1 Apr 2024 and 31 Mar 2025, HKD 300 if between 1 Apr 2025 and 31 Mar 2026. Totals shown in the IRD table. | |

After submission, your application is processed and you will receive your Business Registration Certificate together with your incorporation or registration certificate under the one-stop service.

The format looks like this: 11111111-&&&-&&&-&&-&. The BRN is only the first 8 digits. Ignore the characters after the dash on the certificate string.

Companies incorporated in Hong Kong are automatically within the scope of the Business Registration Ordinance (Cap. 310) and must obtain a BRN.

Difference Between Business Registration and Company Registration

In Hong Kong, business registration and company registration are distinct. Company registration is mandatory if you choose the company route. Business registration is a separate requirement under the BRO.

| Category | Business Registration | Company Registration |

|---|---|---|

| Requirement | Mandatory for all businesses for tax and government identification | Mandatory if you operate as a company |

| Regulating Authority | Business Registration Office, IRD | Companies Registry (CR) |

| Primary Purpose | Obtain Business Registration Certificate (BRC) for compliance | Create a separate legal entity under the Companies Ordinance |

| Applicable To | Sole proprietorships, partnerships, and companies | Companies such as private limited companies and registered non-HK companies |

| Legal Status | A business is not a separate entity by itself | A company is a distinct legal entity |

| Liability | Owners are personally liable for business debts | Owners enjoy limited liability |

| Registration Timeline | Within 1 month of starting business operations | At incorporation through the one-stop service |

| Ongoing Compliance | BRC renewal and IRD filings as applicable | Annual return (NAR1) and Companies Ordinance compliance |

| Registration Number | BRN (UBI) | Former CRN. Post-UBI, the BRN is adopted as the identifier on new certificates |

Difference Between CRN and BRN: Overview

| Feature | Business Registration Number (BRN) | Company Registration Number (CRN) |

|---|---|---|

| Issued By | IRD (Business Registration Office) | Companies Registry |

| Format | 8 digits. It is the first 8 digits of the BRC “Certificate No.” | Legacy number found on older documents |

| Location on Certificate | Middle of the Business Registration Certificate | On historical Certificate of Incorporation only |

| Purpose | Primary identifier and TIN | Historical company ID |

| Who Needs It | All businesses except specific BRO exemptions | Companies only |

| Sole Proprietors & Partnerships | Need a BRN | Do not have a CRN |

| Expiration | BRC expires and must be renewed every 1 or 3 years | Former CRN itself does not expire |

Where to Find a CRN or BRN?

Upon incorporation, any Hong Kong company receives two key documents:

- Certificate of Incorporation: for new companies, the “No.” is the BRN.

- Business Registration Certificate (BRC): includes your BRN; the BRN is the first 8 digits of the certificate number.

You can search for your company's CR number on the website of the Hong Kong Companies Registry.

Your company's BR number can be found in the Business Registration Number Enquiry section of the Inland Revenue Department's website.

Please see below for a sample of a Hong Kong company Certificate of Incorporation with the company's CR Number:

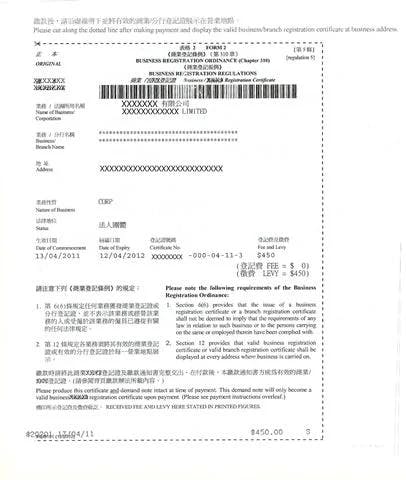

See below for a sample of a Hong Kong Business Registration Certificate with the company's BR Number:

Are There Any Exceptions for CRN or BRN Requirements?

There are no exceptions for obtaining a company registration number if you are doing business in Hong Kong. After UBI, the identifier shown on new company certificates is the BRN.

For business registration, there are two kinds of relief. Do not mix them:

1) Exemption from registration (BRO s.16)

Approved charities that meet statutory conditions, certain agriculture, market gardening or fishing activities, bootblacks, and licensed hawkers (not inside a building) are exempt. Always confirm the exact conditions before relying on an exemption.

2) Exemption from payment of BRC fee and levy

You may apply if your average monthly sales or receipts do not exceed HKD 10,000 for businesses mainly from services or HKD 30,000 for other businesses. Companies incorporated or required to be registered under the Companies Ordinance are not eligible for this payment exemption.

Check this link for further reading of “exemption from registration or payment.”

A Quick Look at Unique Business Identifier (UBI) for Hong Kong Companies

The Unique Business Identifier (UBI) streamlines identification by adopting the BRN across Companies Registry records and searches. This improves consistency between CR and IRD systems.

Is the UBI the Same as the CRN?

Yes! In Hong Kong, the Unique Business Identifier (UBI) has taken the place of the Company Registration Number (CRN) for businesses registered with the Companies Registry. Legacy CRNs remain on old documents and can be mapped to BRNs.

Where Will the UBI Be Used?

- The UBI (which is the same as the BRN) will be used when talking to government offices and businesses.

- Companies will use the UBI when filling out forms and sending documents to the Companies Registry.

- People can use the UBI to search for companies through the Electronic Search Services of the Companies Registry.

- For businesses set up or registered on or after December 27, 2023, the UBI will appear as the company “No.” on official certificates, like the Certificate of Incorporation or the Certificate of Registration of Non-Hong Kong Company.

Conclusion

Understanding the BRN and the legacy CRN is essential for operating in Hong Kong. The BRN (UBI) now acts as your primary identifier and tax ID, while the CRN is used only for legacy reference. Make sure you keep your Business Registration Certificate valid, file the right forms on time, and follow local rules to avoid penalties.

Ready to open a business in Hong Kong? Register your company with Air Corporate today for an effortless company registration process, and get approved in under 48 hours.