Starting a business in Hong Kong? You’ll need a Business Registration Certificate (BRC)—the proof that your business is registered with the Inland Revenue Department (IRD) under the Business Registration Ordinance (Cap. 310).

Whether you’re launching a local company, a sole proprietorship, or opening a branch from overseas, this guide answers the most frequently asked questions to help you understand the who, what, when, and how of the Hong Kong business registration.

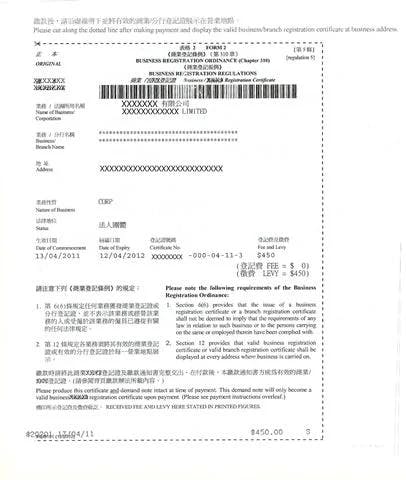

1. What is a Business Registration Certificate in Hong Kong?

A Business Registration Certificate (BRC) in Hong Kong is an official document issued by the Business Registration Office of the Inland Revenue Department (IRD). It proves that your business is registered under the Business Registration Ordinance (Cap. 310) and authorized to operate in Hong Kong.

What the BRC shows (core fields):

- Business Registration Number (BRN) — also your Hong Kong Tax Identification Number

- Business name and company name (if different)

- Business address

- Nature of business

- Date of commencement of business (not the date of incorporation)

- Expiry date of the certificate

If you change particulars (e.g., address, name, nature), notify the IRD within 1 month or via eTAX.

Want to know how your Business Registration Number works? Read our Definitive Guide to Business Registration Number in Hong Kong.

2. Which businesses need a Hong Kong Business Registration Certificate?

Most businesses “carrying on business in Hong Kong” must register, including local companies, overseas companies with a Hong Kong place of business, sole proprietors, partnerships, clubs, and non-Hong Kong persons letting out Hong Kong property.

You must register a business in Hong Kong and obtain a BRC within one month of commencing business.

Pre-commencement applications are generally not accepted, except through the one-stop company incorporation process.

Registration Exemptions (Activity-Based):

Some activities are exempt, including:

- Certain hawkers,

- Specified agriculture, horticulture, fishing activities, and

- Charitable institutions not carrying on a profit-making business.

Always check the IRD list before relying on an exemption.

Learn about the strategic benefits in our article: 7 Reasons Why Companies Register in Hong Kong

3. How can I obtain a Business Registration Certificate in Hong Kong?

The process for Hong Kong business registration depends on how your business is structured.

For Limited Companies

When you incorporate, you apply for business registration at the same time.

Your Certificate of Incorporation and BRC are issued together under the One-Stop Company and Business Registration Service.

If you're still figuring out how to incorporate, follow this 12-step guide to starting a company in Hong Kong.

For Sole Proprietorships and Partnerships

If you’re launching a sole proprietorship or partnership, apply separately through the Business Registration Office of the IRD within 1 month of commencement.

You’ll need to:

- Complete Form 1(a) (individual) or Form 1(c) (partnership/other unincorporated body)

- Select the correct business type

- Pay the applicable Hong Kong business registration fee

Applications can be made online via eTAX, by post, or in person at the Business Registration Office.

For Branch Offices

Each branch of a business must be registered separately and will receive its own Branch Business Registration Certificate in Hong Kong.

4. Which forms do I use?

Use the Inland Revenue Department (IRD) Form 1 series to apply for a Business Registration Certificate (BRC) under the Business Registration Ordinance (Cap. 310).

Choose the form that matches your business type and file within 1 month of commencing business.

| Business type | Correct IRD form | When to use it |

|---|---|---|

| Sole proprietor (individual) | Form 1(a) | You operate as an individual and have started carrying on business in Hong Kong. |

| Body corporate (e.g., limited company not using One-Stop) | Form 1(b) | Your entity is a company or other body corporate that needs a BRC. |

| Partnership / other unincorporated body | Form 1(c) | You run a partnership, club, or unincorporated association. |

| Branch of an existing business | Form 1(d) | You open a branch. Each branch needs its own branch registration. |

IRBR194 is only for requesting blank application forms by post/fax. It is not the application itself.

5. What is a Hong Kong Business Registration Number?

A Business Registration Number (BRN) is an eight-digit number issued by the IRD when you complete Hong Kong business registration.

This number appears on the Hong Kong Business Registration Certificate (BRC) and serves as the company’s Tax Identification Number (TIN).

The BRN is required when conducting business activity that is regulated by government bodies.

Many people confuse the BRN with the Company Registration Number (CRN), which the Companies Registry issues upon incorporation.

To understand the difference between both certificates in detail, please refer to our previous article on this topic.

6. Should I display the Hong Kong Business Registration Certificate for inspection?

Under Hong Kong law, you must display a valid BRC at the principal place of business and a branch registration certificate at each branch.

If your Hong Kong Business certificate was issued electronically, display a printed copy. Inspectors may require production on demand.

This requirement allows government inspectors to verify your business’s legal status at any time.

7. What happens if I fail to comply?

Failure to register on time or to comply with the Business Registration Ordinance (Cap. 310) can lead to a HKD 5,000 fine and up to 1 year’s imprisonment.

Late applicants can also be assessed for back-year fees/levies if more than 12 months late. Register within 1 month to avoid penalties.

8. Are there other licenses and permits needed?

Yes, while a Hong Kong Business Registration Certificate is essential, it's not the only requirement.

Depending on the nature of your business, you may also need specific licenses or permits to operate legally in Hong Kong.

Here are some common examples:

- Food premises/restaurant licences (FEHD)

- SFC licences (Securities and Futures Commission)

- Money service operator license (for currency exchange and remittance services)

- Retail and catering licenses (for shops, restaurants, etc.)

- Education permits (for running training centers or schools)

Always confirm licensing requirements before starting operations, even if your Hong Kong business registration is complete.

9. When do I need to apply for a Business Registration Certificate?

Timing matters when registering your business in Hong Kong. The deadline depends on your business type:

- New Businesses: Apply for a Business Registration Certificate (BRC) within one month of starting operations, as required under the Business Registration Ordinance (Cap. 310).

- Limited Companies: If you’re incorporating under the Companies Ordinance (Cap. 622), the BRC is automatically issued through the One-Stop Company Incorporation and Business Registration Service together with your Certificate of Incorporation.

- Sole Proprietorships, Partnerships, and Branches: Apply for a BRC within one month of business commencement or when opening a new branch.

If you launch a freelance consultancy or open a new retail branch on 1 June, you must register by 30 June to stay compliant.

Failure to register on time can lead to penalties of up to HKD 5,000 and 1 year’s imprisonment, so it’s best to apply early.

10. How much does it cost to apply for a Business Registration Certificate in Hong Kong?

As of the 2025/26 assessment year, the HKD 150 levy for the Protection of Wages on Insolvency Fund (PWIF) remains waived until 31 March 2026.

The current fees payable are:

Standard Business Registration Certificate

- One-Year Certificate: HKD 2,200

- Three-Year Certificate: HKD 5,720

Branch Business Registration Certificate

- One-Year Certificate: HKD 80

- Three-Year Certificate: HKD 208

These amounts include the registration fee (under Cap. 310) but exclude the PWIF levy, which is currently waived.

11. When can Hong Kong business registration fees/levies be waived (payment exemption)?

Business registration fees and levies in Hong Kong are normally payable by all businesses carrying on activities in Hong Kong under the Business Registration Ordinance (Cap. 310).

However, two types of waivers or exemptions exist:

1. Government-Announced Waivers

From time to time, the Financial Secretary may waive part of the annual registration fee or levy through the Budget.

- For 2025/26, the Business Registration Levy (HKD 200) is waived until 31 March 2026 for both 1-year and 3-year certificates.

- No application is needed; the reduced amount is shown automatically when you register or renew.

2. Statutory Exemptions (Cap. 310 s.3)

Certain businesses are exempt by law, such as:

- Charitable institutions and trusts of a public character

- Agricultural, market-gardening, or fishing businesses

- Businesses carried on by the HKSAR Government

- Businesses conducted entirely outside Hong Kong by unincorporated owners

To apply, submit Form 3 to the Business Registration Office (in person, by post, or via GovHK) with evidence of eligibility.

Other small or low-turnover businesses are not exempt and must still obtain and renew a Business Registration Certificate (BRC) annually or every 3 years.

12. How do I cancel my business registration?

If you cease business (or cease a branch), notify the IRD within 1 month using Form IRC3113 or by letter stating your BRN/branch number, name, address, date of cessation, and contact details.

For companies, Hong Kong business registration obligations continue until deregistration/dissolution. “Not operating” alone does not end the obligation.

13. Do I still have to pay the Business Registration Fee after cancellation?

Hong Kong business registration fees are charged yearly.

If you cancel your registration part-way through a year, the fee is not refunded on a pro-rata basis. Planning cessation early can help avoid an additional renewal cycle.

Ready to start your business in Hong Kong?

Air Corporate can assist with Hong Kong business registration, Business Registration Certificate (BRC Hong Kong) applications, renewals, branch registrations, and cancellations to keep you compliant with the IRD requirements from day one.