Accounts receivable management (ARM) is all about ensuring a business gets paid for the goods or services it sells on credit. It's the system of processes a company implements to track outstanding invoices, collect payments from customers, and ultimately maximize cash flow.

If you're a business owner, then you know that managing your accounts receivable is essential to success.

But what is account receivables management? And more importantly, what can it do for your business?

We'll discuss AR management in detail and explain how it can help you streamline your operations and increase profits.

What Is Accounts Receivable?

Before you can learn about AR management, it's important to know what account receivables are.

Simply put, accounts receivable (AR) is the money that customers owe your business for products or services provided on credit.

This could include things like a purchase order from customers with unpaid invoices or an open payment term from another company that hasn't sent in their bill yet.

Businesses use AR financing options so they don't have to wait until all of their invoices get paid before they can receive funds back into their bank account and continue operating smoothly without interruption due to these fund shortages, which would otherwise be caused by unpaid bills coming up short in cash flow.

If there was no such thing as AR management, then companies would not have this option available to them!

And while many businesses choose not to use these financing options because they think it's too risky, there are also those who feel like taking on a little more risk is worth paying off their bills sooner rather than later.

What Is Receivables Management?

The accounts receivable management processes include overseeing and collecting money owed by customers. It involves everything from setting the terms of credit sales to ensuring timely payments and minimizing unpaid debts. Here's a breakdown of its key aspects:

- Monitoring outstanding payments: This involves keeping track of how much money customers owe and when the payments are due.

- Collecting payments: This includes sending invoices, following up on late payments, and taking steps to collect overdue debts.

- Minimizing bad debt: This refers to uncollected revenue that a business writes off as a loss. Effective receivables management helps businesses reduce the risk of bad debt.

Overall, effective accounts receivable management is crucial for maintaining a healthy cash flow and ensuring the financial health of a business.

Why Are Accounts Receivable Important?

Accounts Receivable are important to a company because they represent cash that is owed by customers.

This money can be used to pay expenses, fund day-to-day operations, and grow the business.

The Accounts Receivable account on your balance sheet shows you how much money is due from your clients at any given time in the form of invoices that haven't yet been paid or settled with account credit.

You should keep track of these receivables so that you know which clients have outstanding payments and what their payment terms (i.e., how long until it's due) are.

If you don't have a good system for managing your accounts receivable, you may miss out on potential revenue and wind up with bad debt.

You also need to be able to track payments so that you know when someone has paid an invoice and can mark it as “paid” in your accounting software.

This will help keep your books accurate.

There are a few key things to remember when it comes to accounts receivables management:

- Stay organized! Keep track of invoices, payments, and account credits in a spreadsheet or other tracking tool.

- Follow up with clients who haven't paid their invoices yet! Don't let money just sit there. Send them reminder emails or call them to see what's going on.

- Use good accounting software that can help you track payments and keep your books accurate. This will save you time and headaches down the road.

Managing your Accounts Receivable is important for any business, big or small.

By following these tips, you can make sure that this aspect of your finances is taken care of and doesn't become a headache.

The Accounts Receivable Process

The accounts receivable process is the system that a company uses to track and manage payments owed to it by its customers.

This process usually begins when a customer places an order with a company and ends when that customer has paid for all of the products or services they ordered.

The accounts receivable process involves several steps, including:

- Tracking orders and invoices

- Determining which invoices are due for payment

- Issuing bills and reminders to customers

- Collecting payments from customers

- Recording payments in the accounting system

Companies use various methods to track and manage their accounts receivable, including specialized software, spreadsheets, and handwritten ledgers.

However, the most important part of the process is ensuring that all payments are tracked and recorded in the accounting system.

This allows companies to keep accurate records of their income and expenses and make informed decisions about their financial future.

The accounts receivable process can be complex and time-consuming, but it's essential for any business that wants to maintain healthy finances.

By understanding the basics of this process, business owners can ensure that they're taking steps to protect their bottom line.

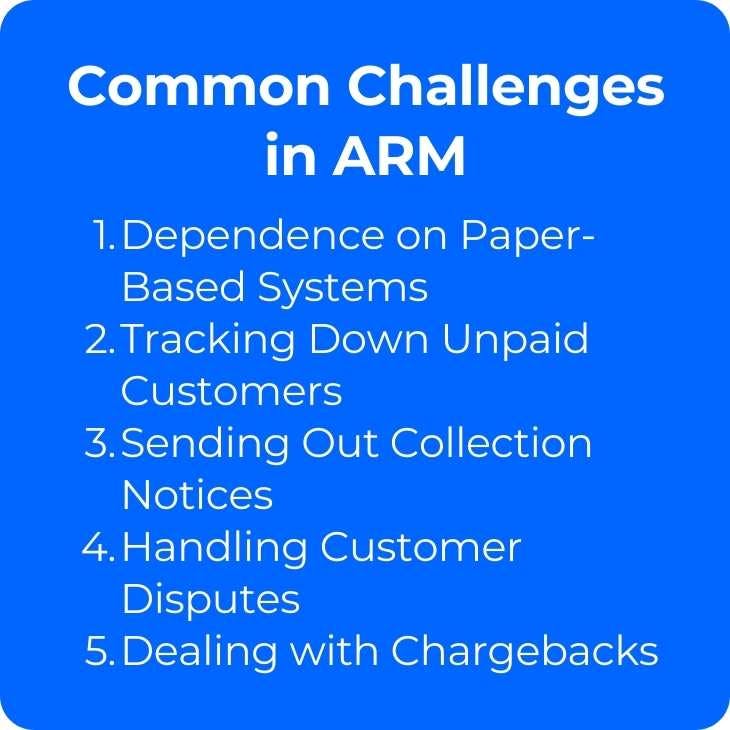

Common Challenges in ARM

Accounts receivable management is the process of managing customer payments.

This has become a necessary task for businesses that want to ensure that they get paid by their clients on time, if not early.

The problem with this system is it can be tedious and challenging in many ways:

Dependence on Paper-Based Systems

Some companies still use paper-based processes to manage accounts receivables.

If a company uses an online or cloud accounting system, its employees might have to manually update the records occasionally, which can make things more prone to human error.

Then some rely on manual payment processing through checks or cash, which takes longer than electronic payments such as credit cards and wire transfers via banks (ACH).

Tracking Down Unpaid Customers

Trying to track down customers who have outstanding invoices can be a daunting task.

This is especially true if the company is using an outdated or manual system in which information about these debts may not be readily available.

In some cases, it might require calling customers or sending them letters in order to remind them of their obligations.

Sending Out Collection Notices

Another challenge lies in determining when it's time to send out a collection notice.

If a business sends out too many notices, it could alienate its customers and lose future business opportunities.

However, if they wait too long, the debt could become harder to collect and the customer's credit score could take a hit.

Handling Customer Disputes

Disputes with customers can also create a challenge for businesses.

This may include disagreements about the invoice amount, the quality of the product or service provided, or late delivery.

In some cases, it might require going to court in order to resolve the dispute.

Dealing with Chargebacks

A chargeback happens when a customer disputes a credit card payment that was made to your business.

The bank then reverses the transaction and charges back the funds to your account.

This can be costly for your business, as you will need to pay administrative fees and any legal expenses incurred in fighting the chargeback.

Companies face many challenges when trying to manage their accounts receivable effectively.

By understanding these challenges, businesses can develop strategies to overcome them and improve their accounts receivable management process.

Automating the AR Process

When it comes to automating the accounts receivables process, there are a few different options that businesses can choose from.

One option is to outsource the entire process to a third-party company.

This can be helpful for businesses that don't have the staff or resources to handle AR themselves.

Outsourcing also allows companies to focus on their core competencies and leave the AR management to specialists.

Another option is to use software that helps automate some of the tasks related to AR.

This can include invoicing, tracking payments, and generating reports.

Automated software can save time and energy, making it easier for businesses to keep track of their receivables.

A final option is to combine outsourcing with automated software.

This can be a great option for businesses that want the benefits of both options.

By outsourcing to a specialist and using software to automate tasks, businesses can get the best of both worlds.

No matter which option businesses choose, it's important to make sure that the AR process is as efficient and effective as possible.

Automating the process can help ensure this happens.

Here are some ideas:

- Use specialized software to automate the invoicing and tracking of payments.

- Automated systems can flag potential problems with customers' credit ratings, helping you avoid late or missed payments.

- Have your bank set up automatic withdrawals for regularly scheduled bills, such as rent or loan payments. This will help ensure that payments are never missed or late.

- When possible, customers can pay online using a secure payment gateway. This helps to speed up the processing of payments and reduces the chances of human error.

- Invest in automated reconciliation tools that compare customer account data against your own records regularly. This will help you quickly identify discrepancies and take corrective action before they become bigger problems.

- Automate the process of reconciling accounts. This will save you time and help to reduce errors between your books and those of your customers.

What Next?

The process of accounts receivable management can be complex and challenging for businesses.

However, by using automated tools and outsourcing to specialists, businesses can make the process easier and more efficient.

By automating the process and focusing on their core competencies, businesses can improve their bottom line and ensure that they are getting paid for the products or services they provide.

Is your business looking for a way to make AGM less of a hassle?

Choose Air Corporate as your dedicated accounting service provider and get world-class accounting, or more, for your company.