Offshore banking allows individuals and businesses to manage finances across borders.

It provides benefits like asset protection, tax optimization, and multi-currency access.

Popular offshore banking destinations include Switzerland, Hong Kong, and Singapore.

While legal, offshore accounts must comply with tax laws and reporting requirements.

Global regulations are increasing scrutiny on offshore accounts to prevent tax evasion.

Most people associate the term "offshore bank accounts," also known as "offshore savings accounts," with multinational corporations or ultra-rich millionaires carrying out illegal activities such as evading taxes.

In reality, though, offshore banking is a completely legal and valuable way to manage financial commitments spread across jurisdictions.

What is an Offshore Bank Account and Why Use One?

An offshore bank account is held in a country other than an individual’s residence or a business’s country of incorporation. For example, a company registered in Hong Kong with a business account in another country has an offshore account.

Despite common misconceptions, offshore banking is legal and widely used for legitimate financial management. While unlawful activities such as tax evasion and money laundering carry serious consequences, an offshore account itself is simply a financial tool.

Common reasons for opening an offshore account include:

- Living or working overseas

- Planning an international move for work or retirement

- Regularly relocating for job assignments

- Frequent business travel across countries

- Receiving income in a foreign currency, such as freelance payments

- Holding international assets like property or investments

- Providing financial support to family members abroad

Why Choose an Offshore Bank Account?

Maintaining accounts in a different country with a relaxed tax system can also offer attractive tax benefits, incentives, and opportunities. Offshore account holders earn higher competitive interest rates on deposits than domestic accounts in their home country.

Pros and Cons of Offshore Banking

While there are potential benefits to having an offshore bank account, it's crucial to consider the legal and ethical aspects before deciding to open one.

| Pros | Cons |

|---|---|

| Asset Protection | Higher Costs |

| Certain jurisdictions provide strong legal protections against lawsuits, creditors, or political instability. | Offshore accounts often come with high fees for account opening, maintenance, and transactions, along with higher minimum deposit requirements. |

| Privacy and Confidentiality | Reduced Transparency and Regulation |

| Some offshore banks have strict banking secrecy laws, offering enhanced financial privacy. | Some offshore jurisdictions have weaker regulations, increasing the risk of fraud and financial misconduct. |

| Diversification | Heightened Scrutiny |

| Holding funds in multiple currencies across different financial markets helps mitigate economic instability and currency fluctuations. | Authorities are cracking down on offshore tax evasion, and improper disclosure can lead to heavy fines and penalties. |

| Investment Opportunities | Complicated Compliance |

| Access to global investment options, such as foreign stocks and bonds, that may not be available domestically. | Offshore banking often requires meeting complex reporting obligations, which can be time-consuming and require professional assistance. |

| Tax Optimization | |

| Some offshore jurisdictions offer low or no taxes on specific financial activities, but professional tax guidance is essential for compliance. |

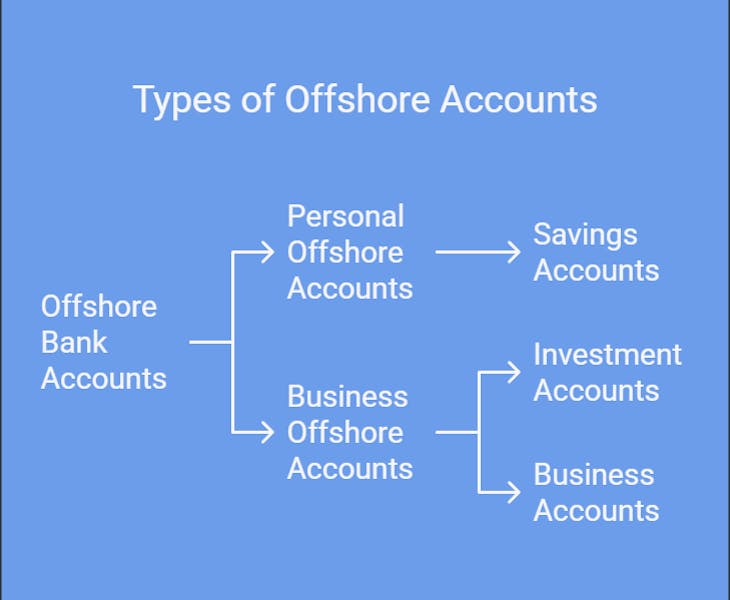

Types of Offshore Accounts

Offshore bank accounts come in different types, each serving specific financial needs. Common options include savings, investment, and business accounts. Depending on financial goals, individuals and businesses may hold multiple accounts across different countries.

Personal offshore accounts allow individuals to manage their finances internationally. Many high-net-worth individuals use offshore savings accounts to hold foreign assets and diversify their wealth outside their home country.

Business offshore accounts cater to companies operating beyond their country of registration. These accounts help streamline international transactions, reduce currency conversion losses, and facilitate global business operations.

Choosing the right offshore account depends on financial objectives, ensuring it aligns with personal or corporate needs.

How to Choose Your Best Offshore Banking Jurisdiction

Offshore banking hubs generally offer strong security and customer support, but selecting the right jurisdiction requires careful consideration. Key factors include:

- Economic and Political Stability: Select a country with a stable economy and government to reduce the risk of regulatory changes and financial crises affecting your investments.

- Remote Account Opening: Consider whether the bank allows you to open an account remotely without requiring an in-person visit.

- Internet Banking Accessibility: Ensure the bank offers comprehensive online banking services so you can manage your account from anywhere at any time.

- Banking Infrastructure and Privacy Laws: Choose a jurisdiction with a well-established financial system and strong privacy regulations, including strict bank secrecy laws and limited automatic information exchange agreements.

- Multi-Currency Account Options: Opt for a bank that provides multi-currency accounts to simplify international transactions and eliminate the need for multiple accounts.

- Reputation of Financial Institutions: Research customer reviews, compare banking fees and services, and verify the institution's financial stability and credibility.

- Minimum Initial Deposit Requirements: Check whether the bank requires a minimum initial deposit, as some jurisdictions allow offshore accounts with no deposit.

- International Transfer Fees: Compare transfer fees across different banks and account types, as costs for overseas transactions can vary significantly.

Best Countries for Offshore Bank Accounts

Several countries allow you to set up an offshore bank account. Most are known for their business-friendly laws and economic stability.

1. British Virgin Islands (BVI)

The British Virgin Islands is a leading offshore financial center, known for its flexible corporate structures, tax advantages, and strong legal framework. BVI banks and financial institutions cater to high-net-worth individuals and businesses seeking asset protection and confidentiality.

- Privacy & Security: BVI offers a high level of financial confidentiality, with limited public disclosure requirements.

- Political & Economic Stability: As a British Overseas Territory, BVI benefits from a stable legal and regulatory system.

- Strong Financial Market: BVI is home to thousands of offshore companies and trusts, making it a global hub for asset management.

- Investment-Friendly: The jurisdiction provides favorable tax structures, estate planning solutions, and access to international financial services.

2. Hong Kong

As a major financial hub in Asia, Hong Kong offers a strong banking infrastructure and business-friendly policies, making it an ideal offshore banking destination.

- No Capital Controls: No restrictions on fund inflows or outflows.

- Business Gateway to Asia: Strategic access to the Chinese market.

- Remote Account Opening: Some banks allow non-residents to open corporate accounts online.

- Strong Legal Framework: Financial privacy and tax benefits attract global investors.

3. The Cayman Islands

The Cayman Islands is a well-known offshore banking hub, offering high levels of financial privacy and zero taxation on income, capital gains, or corporate profits.

- Tax-Free Jurisdiction: No direct taxes on individuals or businesses.

- Remote Banking Access: Many banks allow online account setup for non-residents.

- Strict Financial Regulations: Ensures security and confidentiality for account holders.

- Global Investment Services: Offshore banking here includes investment and estate management services.

4. Belize

Belize is a rising offshore banking destination, offering competitive interest rates and financial privacy.

- High Interest Rates: Offers some of the highest real interest rates globally.

- Strict Privacy Laws: Banks are prohibited from disclosing account information.

- No Exchange Controls: Funds can be moved freely in and out of Belize.

- Political Stability: A secure jurisdiction for offshore accounts.

5. Singapore

Singapore is a top offshore banking location due to its strong economy, financial security, and business-friendly policies.

- Tax Advantages: No capital gains tax and a territorial tax system.

- Advanced Banking Services: Offers wealth management, tax planning, and investment management.

- Stable Political & Economic Environment: A prime choice for international businesses.

- Regulatory Considerations: Some banks require in-person visits for account opening.

6. The Republic of Seychelles

Seychelles has become a growing offshore banking hub, offering financial privacy and attractive non-taxation policies.

- Zero Tax on Foreign Income: Offshore accounts are exempt from local taxes.

- Confidentiality: Strong banking privacy laws protect account holders.

- Ease of Banking: Straightforward account opening process for non-residents.

7. Mauritius

Mauritius is an emerging offshore banking destination, known for its strong financial sector and tax benefits.

- Low Tax Environment: No capital gains tax and favorable corporate tax rates.

- Stable Financial System: Regulated by the Financial Services Commission (FSC).

- Business-Friendly Policies: Ideal for companies expanding into Africa and Asia.

8. The United Arab Emirates (UAE)

The UAE, particularly Dubai, has positioned itself as a premier offshore banking hub.

- Zero Personal Income Tax: No taxation on personal wealth or foreign-earned income.

- Strong Financial Security: Banking secrecy laws ensure client privacy.

- International Business Hub: Ideal for global entrepreneurs and investors.

9. Luxembourg

Luxembourg is a top financial center in Europe, known for its strong banking sector and investor protection laws.

- Secure Banking System: One of the safest banking environments globally.

- Investment Opportunities: Access to European financial markets and wealth management services.

- Strict Confidentiality Laws: Protects the privacy of account holders.

10. Panama

Panama remains a popular offshore banking destination, offering financial privacy and ease of doing business.

- Banking Privacy: Strict regulations limit the disclosure of account information.

- Business-Friendly Laws: Ideal for entrepreneurs looking to open offshore corporations.

- Tax Benefits: Offshore earnings are not subject to local taxation.

Final Thoughts

Setting up a bank account in a foreign jurisdiction can ease the operations of your offshore company and help it thrive. But choosing the best destination for account opening depends on what works for your business, as there is no one-size-fits-all solution.

Want to open an offshore bank account in Hong Kong? Register with Air Corporate today. We can also set up your offshore company in Hong Kong and provide remote business account access.

FAQs

Offshore company incorporation is not always mandatory when opening an offshore bank account. Many banks allow individuals to open personal ones.

Suppose you hold investments in a foreign country in an individual capacity, spend part of the year living in a different country, or even provide financial support to someone who lives overseas. In that case, you are eligible to open such bank accounts.

However, as a parent company, you may incorporate an offshore company to enjoy tax benefits and a better regulatory regime.

1. Gather Basic Requirements

- Provide personal details (name, birthdate, address, citizenship, occupation).

- Submit proof of address (recent utility bill or bank statement).

- Some banks may require notarization or an apostille stamp.

2. Submit Additional Documentation

- Financial references, such as bank statements or reference letters, may be needed.

- Compliance with anti-money laundering (AML) laws may require extra verification.

3. Choose the Right Currency

- Offshore accounts offer multi-currency options.

- Consider exchange rate fees when making deposits or withdrawals.

4. Complete the Application Process

- Some banks require an in-person visit, while others allow online applications.

5. Manage Deposits and Withdrawals

- Use international wire transfers to fund the account.

- Offshore banks may issue debit cards for convenient access.

- Checks may have limited acceptance and higher fees.

6. Utilize Online and Mobile Banking

- Secure online platforms allow remote account management.

- Monitor transactions, transfer funds, and manage finances in real time.

When you open an offshore bank account remotely, you'll need to have your documents officially authenticated. Make sure to provide authorized copies of documents such as proof of address, citizenship, and income, in addition to bank statements and your tax ID number.