What: A private document confirming a company’s current directors/officers and authorized signatories.

When needed: Often requested for corporate bank account opening, cross-border transactions with foreign partners, lending, major deals, and other due diligence checks.

Who issues: Commonly prepared by the company secretary (in-house or outsourced) or a reliable service provider such as a TCSP; some recipients also ask for endorsement by a Hong Kong solicitor or CPA.

Validity: No legal expiry date, but recipients usually require a “recently issued” certificate; practices vary (for example, some ask for 30–90 days, others 3–6 months).

Requirements: Current company records (appointments/resignations, signatory authority) and accurate particulars (including the Business Registration Number shown on the Business Registration Certificate and tied to the annual business registration fee).

Costs and timeline: Provider fees vary by scope and urgency; add-on costs may apply for notarization/apostille and courier delivery.

Key tip: Confirm the recipient’s exact requirements (who must sign, whether a stamp/seal is expected, and whether notarization/apostille is required) before issuing the final version.

Obtaining a Certificate of Incumbency can be an easy process if you have the right business support. It’s also a formal document in your company’s formation post-incorporation.

What Is a Certificate of Incumbency?

A Certificate of Incumbency (sometimes shortened to “COI”) is a private corporate document that confirms a Hong Kong company’s current directors and officers and identifies the individuals authorized to act and sign on the company’s behalf for legally binding transactions, such as opening bank accounts, signing contracts, or executing corporate documents.

The COI is commonly used by banks, lenders, and business partners in due diligence to verify signing authority and reduce the risk of unauthorized transactions.

Depending on the company’s structure and jurisdiction, the certificate may list positions such as:

- Directors

- Company secretary

- CEO

- President

- Vice president

- Treasurer

In Hong Kong, a Certificate of Incumbency is not a statutory filing with the Companies Registry. It is typically prepared using the company’s up-to-date internal records and, depending on the recipient’s requirements, may be signed by the company secretary and/or a director and stamped with the company chop or company seal (if the company uses one).

Alternative Names for Incumbency Certificate

Depending on the recipient, you may see similar documents described as a “certificate of officers,” “secretary’s certificate,” or a “register of directors/officers” type confirmation.

These labels are not standardized, so it is usually more reliable to confirm what information the recipient needs rather than relying on the document name alone.

Some institutions may also accept an official Companies Registry extract (Company Particulars Report) instead of a privately issued incumbency certificate, especially when they only need public particulars.

When Do You Need a Certificate of Incumbency?

A Certificate of Incumbency is typically requested when a third party needs comfort that the person signing has legal authority and that the company’s key officers are correctly identified.

In practice, it comes up most often in banking, financing, and cross-border due diligence for financial transactions.

Whether it is mandatory depends on the recipient. Some will accept a Company Particulars Report; others ask for a Certificate of Incumbency because it can confirm signatory authority and provide a consolidated, signed snapshot of the company’s current leadership.

Opening a Corporate Bank Account

Financial institutions may request a Certificate of Incumbency to confirm that the proposed account signers are authorized to bind the company and to cross-check the company’s officers against due diligence records. This is common both for local onboarding and for overseas banks dealing with a Hong Kong company.

If the bank accepts a Companies Registry Company Particulars Report instead, it may still request additional evidence of signing authority (for example, board resolutions or mandate documents) depending on the bank’s internal requirements.

International Business Transactions and Overseas Deals

Cross-border counterparties and international partners often ask for a Certificate of Incumbency when they cannot easily rely on Hong Kong registry searches or when they want a signed confirmation of who can execute transaction documents.

For certain overseas registrations (for example, setting up an overseas branch/registration), the receiving authority or corporate service provider may require an incumbency certificate as part of the package to verify governance and signatory authority.

Overseas counterparties may also ask for proof of the company’s existence, typically through a Certificate of Continuing Registration/Good Standing or a Companies Registry search.

Loan Applications and Financing

Lenders may request a Certificate of Incumbency to confirm that the individual signing loan documents has authority to commit the company. This is especially relevant where the lender is not familiar with the company’s governance or where signatory authority must be verified before drawdown.

Mergers and Acquisitions

In M&A and similar corporate transactions, a Certificate of Incumbency can be used to support closing checklists by confirming who holds office and who can sign specific documents. It is often paired with board approvals and other transaction authorizations.

Legal and Compliance Requirements

Law firms, auditors, and regulated service providers may request a Certificate of Incumbency as part of client onboarding or transaction due diligence to verify identity, title, and authority.

It is not automatically required by Hong Kong law for routine operations, but it can become practically necessary when a third party’s compliance policy requires it.

What Does a Certificate of Incumbency Include?

A COI typically confirms the current officers and directors of a company and identifies those authorized to act on its behalf. While there is no statutory format under Hong Kong law, most certificates include the following core information:

- Company name and identification number

- Company identification number (e.g., Business Registration Number or Company Number)

- Registered office address

- Date of incorporation

- Date the certificate is issued

- Names and titles of current directors

- Company secretary details

- Names of authorized signatories

- Description of signing authority or powers of representation

- Specimen signatures of listed directors or authorized officers (if requested)

- Summary of issued or authorized share capital

The certificate is typically signed by a director or the company secretary and may include the company chop if used.

Additional Information (If Requested)

Depending on the recipient’s requirements (for example, banks, investors, or counterparties), a COI may also include:

- Names and titles of senior officers (such as CEO, CFO, COO, or treasurer)

- Confirmation of current shareholders or members

- General description of the company’s ownership or corporate structure

- Transaction-specific wording confirming authority for a particular deal

Beneficial owners (UBOs) are not included by default. In Hong Kong, UBOs are recorded in the Significant Controllers Register (SCR) kept at the company’s office. The SCR is not publicly accessible. Beneficial owners are typically only referenced in a COI if specifically requested by the recipient as part of enhanced due diligence.

Related Documents Often Confused with a COI

| Document | Issuer | What It Proves | Typical Use |

|---|---|---|---|

| Certificate of Incumbency | Company, TCSP, solicitor, CPA, or registered agent | Current directors, officers, and authorized signatories | Banking KYC, major transactions, vendor onboarding |

| Company Particulars Report | Companies Registry | Public company data (directors, secretary, share capital, latest filed shareholder data) | Registry verification |

| Certificate of Good Standing / Continuing Registration | Companies Registry | Company is active and not struck off | Cross-border transactions |

| Apostille | High Court | Authentication of signature or seal for overseas use | Hague Convention jurisdictions |

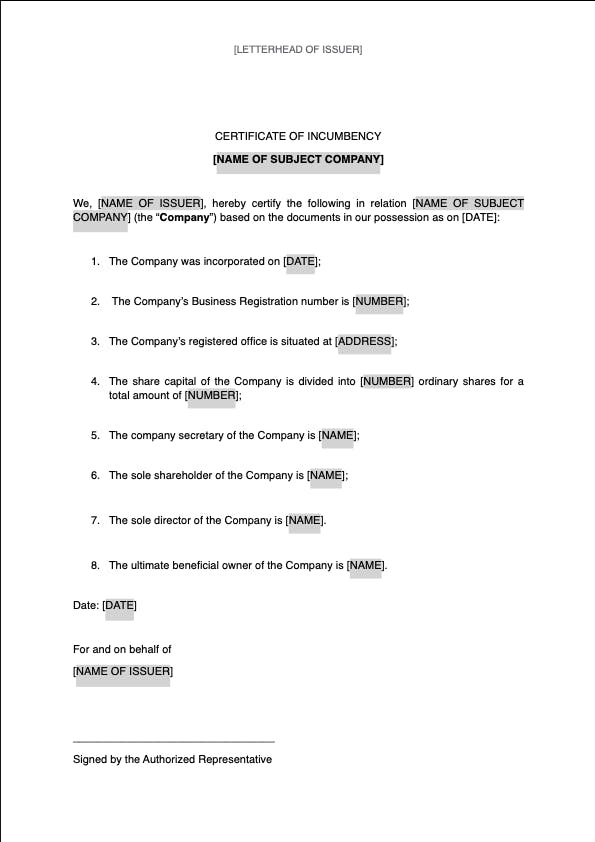

Certificate of Incumbency Example

A typical Hong Kong Certificate of Incumbency is a one- to two-page document on the issuer’s letterhead (or the company’s letterhead), dated and signed, that lists company particulars, current directors/officers, and authorized signers.

Recipients may also request the corporate seal if the company uses one, although a seal is not legally required for most documents under Hong Kong company practice; the key point is meeting the recipient’s acceptance criteria.

Who Can Issue a Certificate of Incumbency in Hong Kong?

The certificate is commonly issued or certified by the company secretary (in-house or outsourced) based on the company’s statutory records, and may be endorsed by a Hong Kong solicitor or CPA if overseas partners or overseas banks require independent professional comfort.

Some counterparties will accept a certificate signed by a director (sometimes together with the company secretary), while others prefer it to come from a professional firm acting as company secretary or advisor. Acceptance is policy-driven by the recipient.

How to Obtain a Certificate of Incumbency in Hong Kong

Obtaining a Certificate of Incumbency is usually an administrative process: confirm the recipient’s requirements, ensure company records are current, and have the certificate prepared and signed by the appropriate person or professional.

If the certificate will be used overseas, the recipient may require notarization and/or an apostille, which should be planned upfront because it affects timing and cost.

1. Update Company Records

Before requesting the certificate, confirm that the company’s director/secretary particulars and other relevant changes have been properly updated (including filings where applicable).

If records are out of date, the certificate may not be acceptable to financial institutions or counterparties.

2. Request From Your Company Secretary or Advisor

Most Hong Kong companies obtain the certificate through their company secretary (including outsourced secretarial firms) or advisor who can prepare it using the company’s records and apply the requested format.

3. Prepare Supporting Documents

Common supporting documents include constitutional documents and internal records that evidence appointments and authority (for example, registers and board authorizations), depending on what the recipient requests.

If the recipient will accept a Companies Registry search instead, you may also obtain a Company Particulars Report as an official public extract.

4. Review the Draft Carefully

Check the company name/identifier, office address, and the spelling of names and titles, and confirm that the authorized signers match the bank mandate or transaction documents. Errors often cause re-issuance and delays.

5. Notarize or Apostille if Required

Notarization and apostille are typically requested for overseas use, depending on the foreign jurisdiction and the recipient’s policy.

Apostille service is provided by the Hong Kong Judiciary at a government fee of HKD 125 per apostille application, and the stated processing time is normally two working days.

6. Receive and Store Copies

Keep a PDF copy and, if needed, a hard copy for submission.

Where the certificate is used for recurring banking or compliance requests, maintaining a controlled, current set of copies helps reduce turnaround time for future requests.

How Long Does It Take and What Does It Cost?

A Certificate of Incumbency can typically be prepared within 1 to 3 business days if corporate records are current. Processing time may extend if board approvals, custom wording, notarization, or apostille services are needed.

Standard Fees

In Hong Kong, service providers typically charge HKD 1,500 to HKD 3,000 for a standard certificate, which includes preparation, record review, and issuance. Express service (same-day or 24-hour turnaround) adds HKD 800 to HKD 1,500.

Legalization for Overseas Use

If the certificate requires legalization for international use:

- Notarization by a Hong Kong notary public: HKD 2,000 to HKD 4,000

- Apostille by the High Court: HKD 1,000 to HKD 2,000+ (including handling fees)

- International courier delivery: HKD 300 to HKD 800, depending on destination and speed

When Costs Increase

Fees may be higher if company records need updating, board resolutions must be drafted, multiple certified copies are required, translation is needed, or the certificate covers multiple group entities.

For a straightforward Hong Kong company, expect total costs starting at HKD 1,500 to HKD 3,000, with additional charges for urgency, legalization, or international delivery. Confirm scope and timeline in advance to avoid unexpected fees and delays.

When Do You Need to Update Your Certificate of Incumbency?

A Certificate of Incumbency is accurate only as of its issue date.

Even without a legal expiry date, it can become unusable if the listed officers, secretary, address, or authorized signers change.

You should generally re-issue it after key changes (for example, director appointment/resignation, change of company secretary, registered office address change, or signatory changes), and before time-sensitive submissions where the recipient requires a recently dated certificate.

Certificate of Incumbency Validity in Hong Kong

A Certificate of Incumbency is valid as of the date it is issued, but it does not remain accurate indefinitely.

Because directors, officers, or authorized signatories may change over time, the certificate can become outdated.

Many banks and counterparties require a valid certificate to confirm current authority.

Updating the document whenever there is a change in corporate appointments or signing authority helps ensure it remains accurate and acceptable when needed.

Company Particulars Report in Hong Kong – Quick Facts

A Company Particulars Report is an official Companies Registry search product that provides public company particulars. Many banks and counterparties use it as an alternative (or supplement) to a privately issued Certificate of Incumbency, depending on what they need to verify.

Where to Get the Company Particulars Report

You can obtain it through the Companies Registry e-Services portal.

The Companies Registry states the fee for a Company Particulars Report is HKD 22.

What the Company Particulars Report Includes

The Companies Registry confirms that shareholder information (for a private company) is obtainable via a Company Particulars Report as part of its online database search services.

It also includes core public particulars such as current directors and company secretary details (as reflected in the Registry’s records).

What the Company Particulars Report Excludes

A Company Particulars Report is a public record extract and does not function as a full internal authority document.

For example, it does not replace internal proof of signing authority (such as board resolutions or account mandates) where the recipient requires those.

Separately, ultimate beneficial ownership information in Hong Kong is typically maintained via internal compliance records (for example, the Significant Controllers Register) rather than being part of standard public registry search outputs.

Best Practices for Using Your Certificate of Incumbency

Confirm the recipient’s requirements before issuance: who must sign (corporate secretary, director, professional firm), whether a corporate seal is expected, whether specimen signatures are required, and whether notarization/apostille is needed for overseas use.

Track the issue date and keep a clean version history. Where recipients apply a “recently issued” rule (for example, 30–90 days or 3–6 months), having a process to refresh the certificate reduces last-minute rework.

Conclusion

A Certificate of Incumbency is a commonly requested private document that confirms a Hong Kong company’s current officers and authorized signers for banking, financing, and due diligence. It is not a statutory filing, and its acceptance depends on the recipient’s policy and the completeness and accuracy of the information provided.

At Air Corporate, our solicitors, CPAs, and licensed company secretaries prepare COIs and Company Particulars Reports that are compliant and bank-ready.

Set up your company or appoint us as your company secretary—we’ll handle your COI and other corporate filings seamlessly.

FAQs

Not always. Many banks accept either a COI or an official Company Particulars Report.

Yes, but banks usually prefer a regulated professional such as your company secretary, solicitor, CPA, or notary.

No, you do not usually have to file a Certificate of Incumbency with the Secretary of State or any government office. This certificate is a private legal document that an authorized company officer prepares. You can have it notarized to make it more official, but that is not required.

Yes, LLCs can issue a Certificate of Incumbency. Usually, an LLC manager or officer prepares this document. The certificate lists the names of the company’s officers, managers, and members as of today. For an LLC, this certificate proves who is responsible for managing and controlling the business.