A Company Evolution

Making the life of entrepreneurs and SMEs easier, one step at the time.

2014

The Air-Corporate concept is born

2018

Launch of our YouTube channel and online platform

2020

Started offering services in Singapore

2022

Trusted by 1.000+ SMEs and entrepreneurs

1,000+

Companies Incorporated

800+

Business Accounts Opened

50+

Industries Covered

25+

Nationalities

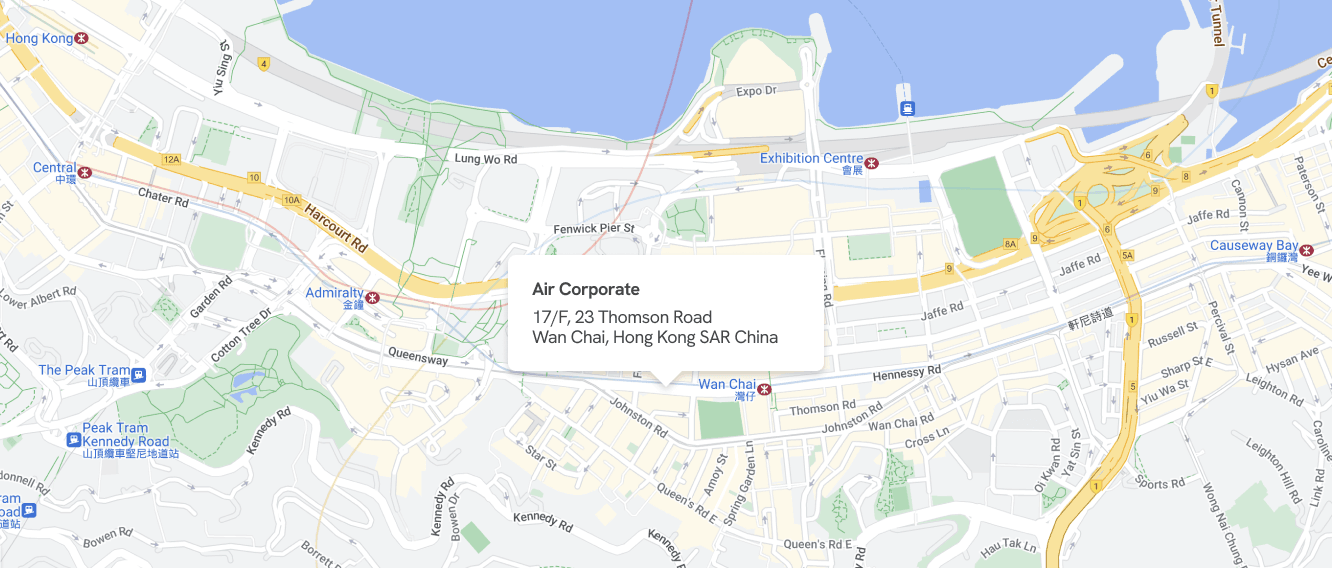

Our office

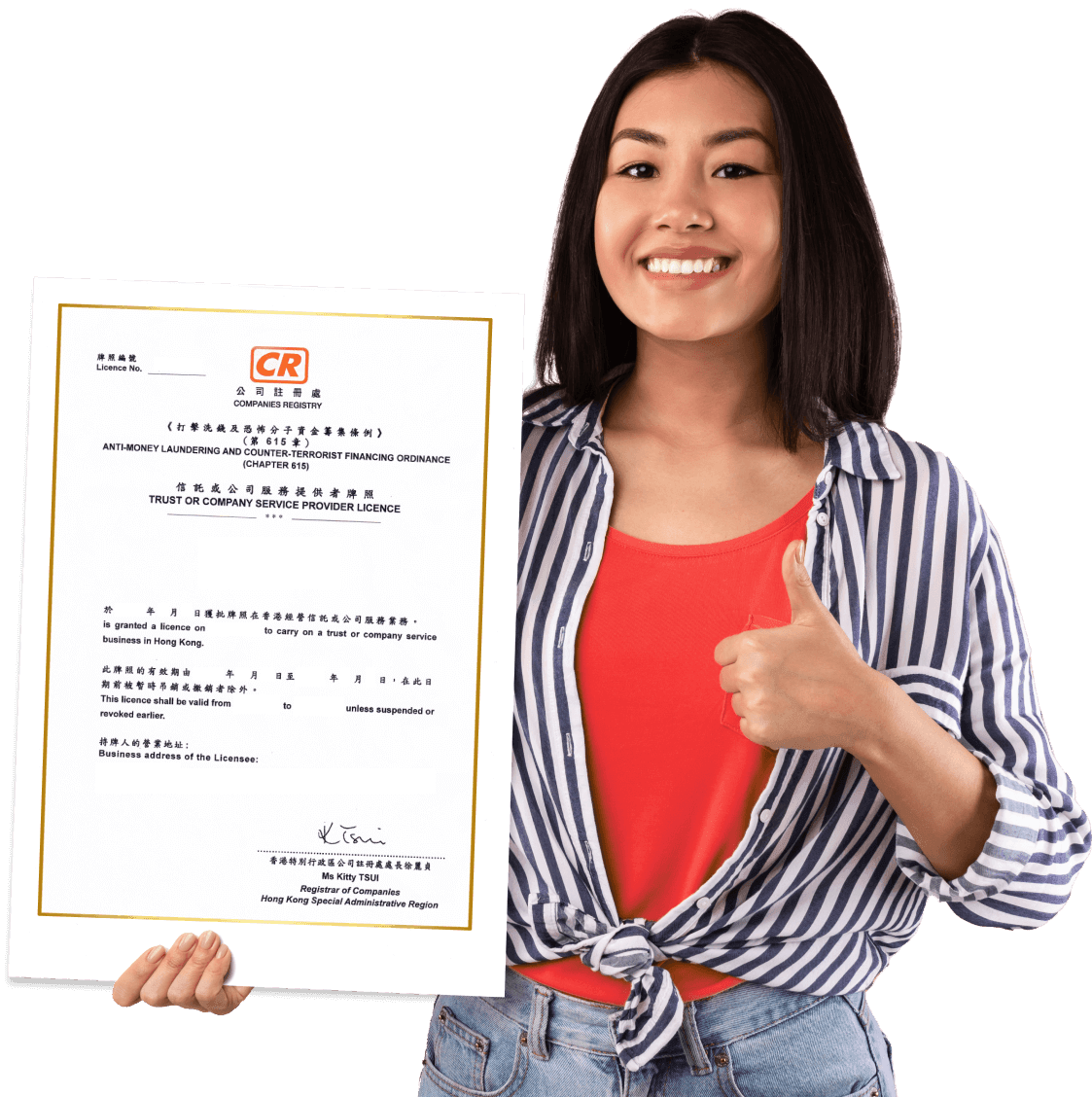

Fully licensed

We are fully licensed as The Air Corporation by the Registry for Trust and Company Service Providers as a Trust or Company Service Provider (TCSP) Licensee with license number

TC0008778

What We Do

Register your HK company remotely

We register all forms of companies in Hong Kong.

Our cloud-based platform helps registering your Hong Kong company easily and in a secured environment. The process takes a few hours only, success guaranteed. You do not need to travel to HK..

Save time, paper and save money.

Manage your company online

After incorporation, you can access and download your company documents on our online platform, accessible 24/7 from anywhere.

You can also use our platform to reorganize your company at any time.

Open your business account online

We help you open a business account for your company all online and remotely with Statrys.

While we can never 100% guarantee the opening of a business account,our success rate is over 95%

We can also help you open a bank account with traditional banks, but this still requires travelling to HK in most cases.

Pain-Free Accounting

Any hour spent by an entrepreneur or business owner on accounting is wasted.

We use the latest digital tools to make sure that you spend as little time as needed on bookkeeping and accounting.

What Makes Us Different

We use the right balance between technology and human experience, we help you save money while keeping you safe when incorporating and managing your company.

Pay Less Get More

Work with Air Corporate and get access great and free resources:

- All your company documents on our online platform

- Digital company chops

- HK compliant invoices templates

- Standard contracts

and much more…

Experts in what we do

Registering a company should be fast and easy, but not be a commodity.

All our team members are experts in their field:

- Company formation

- Company secretaries

- Bookkeepers

- Accountants

- Tax experts

- Lawyers

- Tech experts

Our team members are always here to help you make the right choices and decisions.