The Business Registration Number (BRN) is a unique eight-digit identifier issued by the Inland Revenue Department (IRD) and printed on the certificate. It functions as the entity’s TIN-equivalent across many government and banking processes.

The BRN is used for official filings and interactions, but is not a permit to conduct business by itself.

Businesses carrying on business in Hong Kong (including local entities and non-Hong Kong companies with a place of business in Hong Kong) must obtain a Business Registration Certificate (BRC) within 1 month of commencement. Employees are not treated as carrying on business. Avoid blanket statements about “representative offices”; the test is factual.

Special routing/timing applies to companies incorporated under the Companies Ordinance via one-stop services and to Limited Partnership Funds (LPFs).

A business registration certificate is critical for operating in Hong Kong under the Business Registration Ordinance (Cap. 310).

It confirms your business in Hong Kong is on the IRD register and must be displayed at each place of business.

What Is a Business Registration Certificate (BRC)?

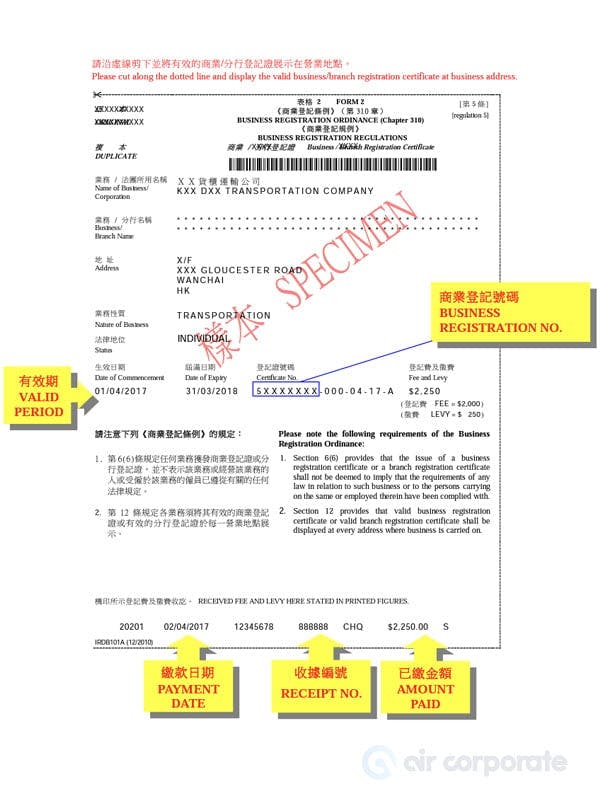

A BRC is issued by the Business Registration Office of the IRD. It shows your:

- Registered name of your business

- The nature of your business

- Business registration number (BRN)

- Issue and expiry date of the certificate

You must display a valid certificate at your business premises (and each branch needs its own branch certificate).

Here's a sample BRC:

Penalty for failing to comply with the Business Registration Ordinance (Cap. 310): up to HKD 5,000 and 1 year’s imprisonment.

Is There a Difference Between BRC and BRN?

The BRC is the certificate of registration.

Meanwhile, the BRN is the eight-digit number printed on the certificate and used across government processes (it is effectively the entity’s TIN-equivalent).

Since 27 December 2023, under the Unique Business Identifier (UBI) regime, the BRN is used consistently across registries.

Which Businesses Must Get a Business Registration Certificate?

You must register if you are carrying on business in Hong Kong for profit (including online activities) or operating a club that provides facilities or services to members for a fee, unless an exemption applies under the Business Registration Ordinance (Cap. 310).

This generally covers:

- Sole proprietorships and partnerships

- Local companies

- Non-Hong Kong companies that establish a place of business in Hong Kong (including branches)

- Clubs charging fees to members

- Limited Partnership Funds (LPFs) registered under the LPF Ordinance (even if they are not actively carrying on business in Hong Kong)

Employees are not treated as “carrying on business.”

Whether a “representative office” must register depends on what it actually does in Hong Kong, so avoid blanket claims.

When Should Your Business Apply for a BRC?

Apply within 1 month of starting a business. IRD does not accept applications before commencement.

| Business type/case | Deadline |

|---|---|

| Sole proprietorship / partnership / unincorporated body | Within 1 month of commencing business |

| Non-Hong Kong company (with a place of business in Hong Kong) / branch | Within 1 month of commencing business/place of business |

| Limited Partnership Fund (LPF) | Notify IRD and complete required submissions within 1 month after commencing relevant business (LPF-specific rules apply) |

| Local company via one-stop (Companies Registry + IRD) | BRC is processed with incorporation; the certificate starts on the incorporation/registration date |

What are the Types of Business Registration Certificates in Hong Kong?

- Standard Business Registration Certificate — for the main business

- Branch Business Registration Certificate — required for each branch

Both are available with 1-year or 3-year validity. You must display a valid certificate at every business location.

Updated Fees for BRC

The IRD publishes an annual table showing the prescribed business registration fees and the Protection of Wages on Insolvency Fund levy. The levy waiver runs until 31 March 2026. A 3-year certificate that begins during the 2025/26 period still attracts HKD 300 levy for the two years after the waiver ends.

The payable amount is generally determined by the certificate’s commencement date. For one-stop applications (e.g., companies incorporated under the Companies Ordinance, non-Hong Kong companies registering under one-stop, LPFs), the relevant date is the date of the incorporation or registration submission, not the later processing date.

Business Registration Certificate Fees and Levy

(Fee + Levy = Total)

| Certificate type | 1 Apr 2025 – 31 Mar 2026 | 1 Apr 2024 – 31 Mar 2025 | 1 Apr 2023 – 31 Mar 2024 |

|---|---|---|---|

| Standard, 1-year | 2,200 + 0 = 2,200 | 2,200 + 0 = 2,200 | 2,000 + 150 = 2,150 |

| Standard, 3-year | 5,720 + 300 = 6,020 | 5,720 + 150 = 5,870 | 5,200 + 450 = 5,650 |

| Branch, 1-year | 80 + 0 = 80 | 80 + 0 = 80 | 73 + 150 = 223 |

| Branch, 3-year | 208 + 300 = 508 | 208 + 150 = 358 | 189 + 450 = 639 |

How Do I Apply for a BRC?

In Person

Submit at the Business Registration Office, 2/F, Inland Revenue Centre, 5 Concorde Road, Kai Tak, Kowloon.

Properly completed counter applications in simple cases can be issued the same visit (typical counter turnaround is within the visit).

By Post

Mail your application to P.O. Box 29015, Concorde Road Post Office, Kowloon.

Properly completed applications are typically processed within 2 working days from receipt.

Online (eTAX)

Use eTAX to apply (eligible for sole proprietors, partnerships, and branches in simple cases).

Properly completed applications are generally processed within 2 working days; electronic certificates are issued.

Who can sign/submit online: the sole proprietor, partners, or a responsible officer (e.g., director/secretary/manager) as specified by IRD’s e-services.

Keep a copy of identity/constitutive documents ready (HKID/passport, Certificate of Incorporation, partners’ IDs, LPF Certificate of Registration, etc.), as required by your case type.

- Confirm your business commencement date.

- Choose 1-year or 3-year certificate.

- Apply within 1 month.

- Display your BRC and obtain a branch certificate for each branch.

What Happens if You Register Late?

- Failing to register within one month of starting business is a criminal offence under the Business Registration Ordinance (Cap. 310), punishable by a fine of up to HKD 5,000 and imprisonment for up to 1 year.

- The IRD may also charge business registration fees (and any applicable levy) for the current year and prior years, based on when you actually started business.

In practice, operating without a valid Business Registration Certificate (BRC) can create problems with banking, contracts, invoicing, and other essential business dealings, as many counterparties will expect to see a BRC.

To avoid these issues, working with a local expert like Air Corporate can help you get registered correctly and on time.

FAQs

A Business Registration Certificate (BRC) is issued by the IRD and shows your business is registered under the Business Registration Ordinance.

A Certificate of Incorporation is issued by the Companies Registry and confirms the company exists as a separate legal entity under the Companies Ordinance.

After you apply and pay via eTAX, an acknowledgement with a Transaction Reference Number appears on screen. This confirms your submission was successful.

You can apply yourself via eTAX or at the Business Registration Office, but many businesses use a firm like Air Corporate to handle the process for them.

If you applied through eTAX and find an error, send a signed written notice to the Commissioner of Inland Revenue with your details, the Transaction Reference Number, the business registration number (if any), and the correction needed.

For companies using the One-Stop online service, the Certificate of Incorporation and BRC are usually issued within about 1 hour.

Paper or postal applications generally take a few working days.

BRCs are valid for either 1 year or 3 years, as shown on the certificate. You must renew before expiry, usually by paying the renewal demand note issued by the IRD.